Breaking bad habits

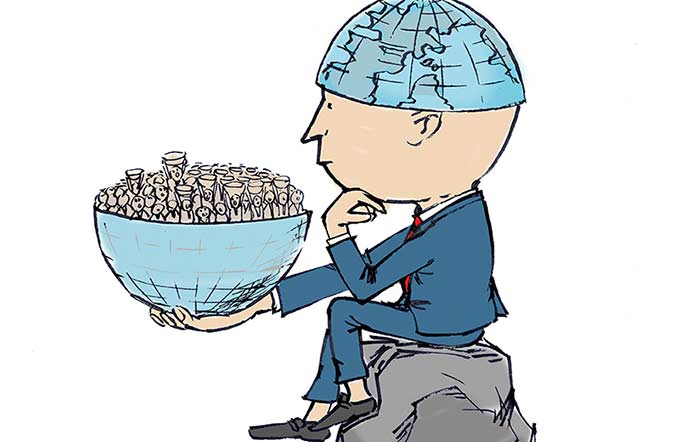

China and US should properly handle excesses in asset and credit markets, and avoid dangerous distortions of economy

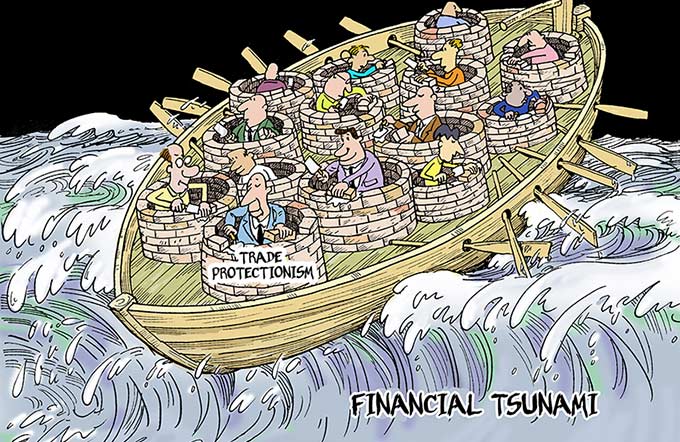

It was never going to be easy, but central banks in the world's two largest economies - the United States and China - finally appear to be embarking on a path to policy normalization. Addicted to an open-ended strain of uber-monetary accommodation that was established in the depths of the global financial crisis of 2008-09, financial markets are now gasping for breath. Ironically, because the traction of unconventional policies has always been limited, the fallout on real economies is likely to be muted.

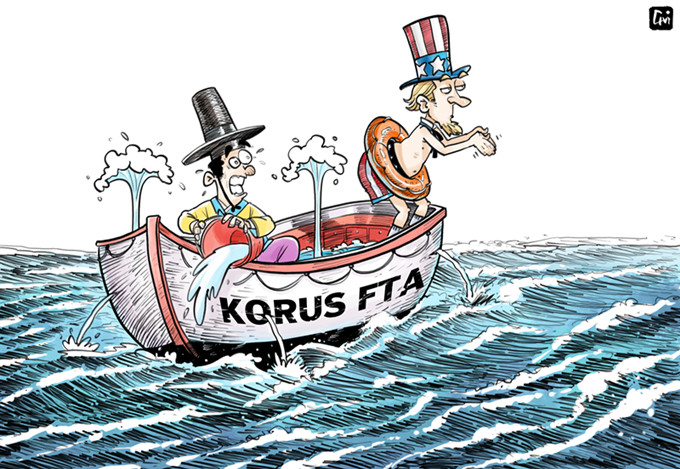

The US Federal Reserve and the People's Bank of China are on the same path, but for very different reasons. For Fed Chairman Ben Bernanke and his colleagues, there seems to be a growing sense that the economic emergency has passed, implying that extraordinary action - namely, a zero-interest-rate policy and a near-quadrupling of its balance sheet - is no longer appropriate. Conversely, the PBOC is engaged in a more preemptive strike - attempting to ensure stability by reducing the excess leverage that has long underpinned the real side of an increasingly credit-dependent Chinese economy.

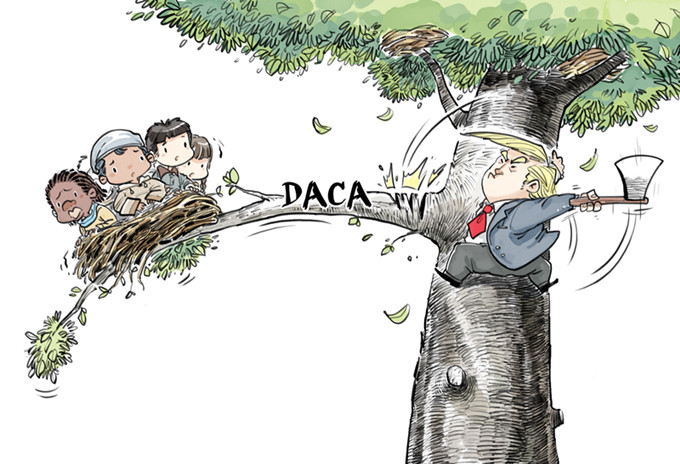

Both actions are correct and long overdue. While the Fed's first round of quantitative easing (QE)helped to end the financial-market turmoil that occurred in the depths of the recent crisis, two subsequent rounds - including the current, open-ended QE3 - have done little to alleviate the lingering pressure on over-extended American consumers. Indeed, household-sector debt is still in excess of 110 percent of disposable personal income and the personal savings rate remains below 3 percent, averages that compare unfavorably with the 75 percent and 7.9 percent norms that prevailed in the final three decades of the 20th century.

With American consumers responding by hunkering down as never before, inflation-adjusted consumer demand has remained stuck on an anemic 0.9 percent annualized growth trajectory since early 2008, keeping the US economy mired in a decidedly subpar recovery. Unable to facilitate balance-sheet repair or stimulate real economic activity, QE has, instead, become a dangerous source of instability in global financial markets.

With the drip feed of QE-induced liquidity now at risk, the recent spasms in financial markets leave little doubt about the growing dangers of speculative excesses that had been building. Fortunately, the Fed is finally facing up to the downside of its grandiose experiment.

Recent developments in China tell a different story - but one with equally powerful implications. There, credit tightening does not follow from determined action by an independent central bank; rather, it reflects an important shift in the basic thrust of the State's economic policies. China's new leadership, headed by President Xi Jinping and Premier Li Keqiang, seems determined to focus policy on the quality of growth.

This shift not only elevates the importance of the pro-consumption agenda of China's 12th Five-Year Plan (2011-15); it also calls into question the longstanding proactive tactics of the country's fiscal and monetary authorities. The policy response - or, more accurately, the policy non-response - to the current slowdown is an important validation of this new approach.