Painkillers do not cure

Even if a last-minute deal in Washington saves the US a debt default for the moment, the world still cannot breathe a sigh of relief for escaping a potentially devastating blow to the global economy.

Instead, the international community should better brace itself for lasting uncertainty over Washington's ability to clean up its fiscal mess.

US House Minority Whip Steny Hoyer (D-MD)(C) walks to a Democratic Caucus meeting discussing the Senate budget deal on Capitol Hill in Washington DC, Oct 16, 2013. US Senate leader said on Wednesday that a bipartisan deal is reached to raise the debt ceiling and reopen the federal government. [Photo / Xinhua]

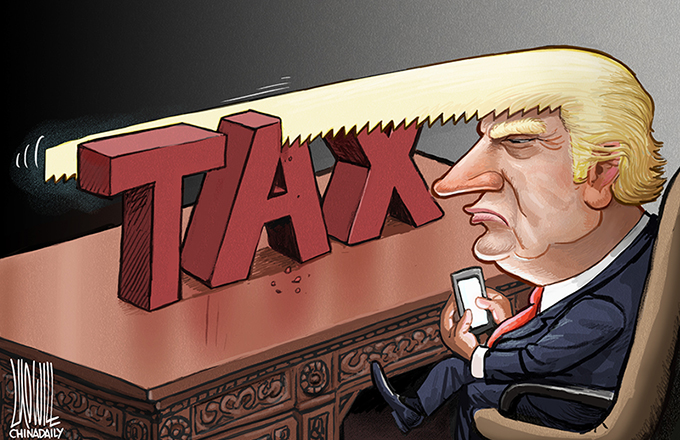

As long as the US keeps using cheap money as a painkiller to delay hard and necessary economic restructuring, it is more than likely that senseless political brinkmanship over the self-imposed US debt ceiling will repeat itself sooner or later.

China's latest decision to tackle its production overcapacity, in a manner more serious than ever, made it crystal clear that economic growth in this country has to be aggressively rebalanced in line with the international economic landscape, which has been recast by the global financial crisis five years ago.

On Tuesday, Beijing issued a guideline to cut industrial overcapacity as a key measure to transform the country's economic growth model that has relied too much on exports and investment for too long.

Admittedly, China's growth miracle over the past three decades owes much to its rise as a manufacturing power on the back of huge demand from developed countries like the US.

But the 2008 global financial crisis awakened Chinese leaders to the reality that the shrinking demand from Western countries has made export-led growth unsustainable. It is thus urgent for China to rebalance its growth away from exports and investment, and toward domestic consumption.

As the largest foreign holder of US Treasury bonds, China does have concerns about a once-unthinkable US debt default. Yet the emphasis that China currently attaches to its economic rebalancing manifests farsightedness that is badly needed among global leaders, particularly in the US.

It will certainly be complicated and painful to cut overcapacity, a move that can easily increase unemployment. But it is a price China has to pay for balanced and sustainable growth.

And while China is trying its best to deal with overcapacity, the US should think twice if cheap money really helps address its overborrowing problem. The fiasco in Washington proves that painkillers are not a cure.

(China Daily 10/17/2013 page8)