|

| WANG XIAOYING/CHINA DAILY |

China's economic slowdown has been the subject of countless debates, discussions, articles and analyses. While the proposed remedies vary considerably, there seems to be a broad consensus that the illness is structural. But another factor has gone largely unnoticed: the business cycle.

For decades, China's economy sustained double-digit GDP growth, but it wasn't immune to the business cycle: in fact, the six-year slowdown China experienced after the 1997 Asian financial crisis was a symptom of precisely such a cycle.

Today, China's business cycle has led to the accumulation of non-performing loans (NPLs) in the corporate sector, just as it did at the turn of the century. While official data show the rate of NPLs is lower than 2 percent, many economists estimate it is more like 3-5 percent. If they are right, NPLs could amount to 6-7 percent of China's GDP.

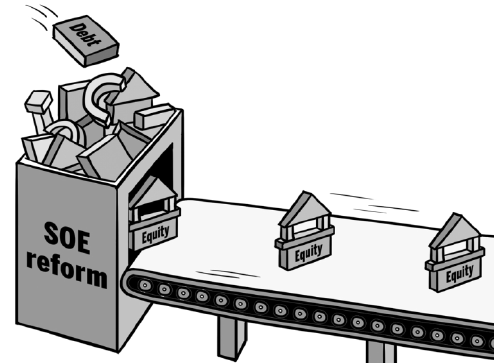

Most of this debt is held by State-owned enterprises, which account for just one-third of industrial output, yet receive more than half of the credit dispensed by China's banks. Though the debt-equity ratio of the industrial sector as a whole has declined over the past 15 years, the SOEs' has increased since the global financial crisis, to an average of 66 percent, 15 percentage points higher than that of other types of enterprises.

That may not have been a problem when China's economy was growing rapidly, but it represents a serious economic risk today, which is why the government has set deleveraging as one of its major tasks for this year. But execution has been slow, owing partly to China's failure to fully enforce its bankruptcy law.

That commercial banks are not allowed to hold shares in companies has also impeded deleveraging, as it prohibits the use of direct debt-equity swaps to reduce SOE debt. This should change.

China has used debt-equity swaps to reduce NPLs in the State sector before. In 1999, it established four asset-management companies (AMCs) to take on the weakest loans of the four-largest State-owned banks, thereby improving those banks' financial stability. And the AMCs made handsome profits from those shares.

Today, too, debt-equity swaps may be the only viable solution to the NPL problem. But instead of relying only on government-owned entities to assume the debt, China should allow private equity funds to act as AMCs, bidding for the NPLs at a discount.

Such an approach would not just address the NPL problem, by giving the private sector a stake in the SOEs, but also help spur performance-enhancing reforms. After all, despite their grim financial performance, many SOEs have a lot going for them, including state-of-the-art equipment, first-rate technical staff and competitive products.

Their problem is bad governance and poor management-a problem that, as China's top leaders recognized in 2013, private-sector involvement can help resolve. Of course, there are some obstacles to introducing debt-equity swaps between the public and private sectors, beginning with concern about the loss of State assets. Given the severity of SOEs' debt problem-the China Railway Corporation alone holds 3 trillion yuan ($449 billion) in debt-discounts are inevitable when SOE debts are transferred to private AMCs. This could cause some to assert that the private companies are realizing unjust gains.

To overcome this obstacle, China should engage in local experimentation-a tried-and-tested approach that has long guided the country's reform-beginning in the regions where the SOE debt problem is the most acute. The resulting revitalization of SOEs would also help quell any doubts about debt-equity swaps with the private sector.

Another obstacle is the fear that, by allowing SOEs, yet again, to escape market discipline, debt-equity swaps would set a dangerous precedent. But the improvements to corporate governance that would follow from the introduction of private shareholders would reduce substantially the likelihood of SOEs continuing to abuse the financial system.

By allowing private-sector participation in debt-equity swaps, China could kill three birds with one stone: advance SOE deleveraging, strengthen corporate governance in the state sector and enhance economic efficiency. With local experimentation, Chinese authorities can map out that stone's most effective trajectory.

The author is the director of the China Center for Economic Research and dean of the National School of Development at Peking University.

Project Syndicate