IoT adoption brings new opportunities for telecom operators

|

|

Li Qiang, Party secretary of Jiangsu province, speaks at the 2016 WIOT Wuxi Summit on Oct 31. [Photo provided to chinadaily.com.cn] |

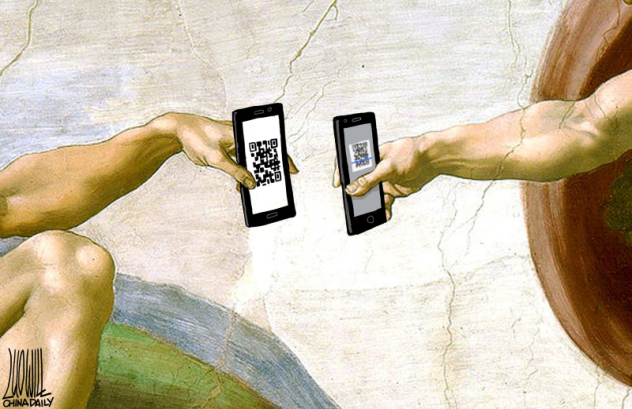

Over the next decade, IoT (Internet Of Things) devices, beyond handheld ones, are expected to impact our lives. Billions of devices will power up by 2020 and by 2030, wearables, Smart City and biometrics sensors as well as automated household devices will be essential to society.

At the end of 2014, China had 74 million connected machines and that number is expected grow that to 336 million by 2020 at an explosive rate of 29 percent annually, according to the GSMA, a telecom interest group. This did not happen by accident. In 2011, the government had the foresight to establish an IoT institute and fund, long before the term became mainstream. Two years ago in 2014, the government designated Smart City projects in more than 200 cities, looking at ways of collecting and analyzing data on public safety, environmental factors and transportation, as examples.

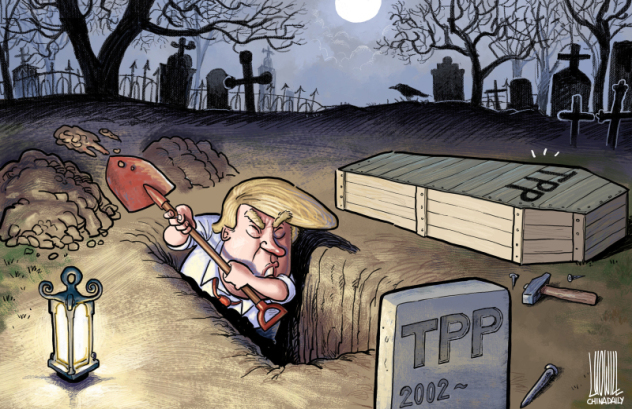

The rate of innovation will be one of the most disruptive trends to grapple with. In the next 20 years, while consumers will benefit from the accelerated rate of change in device and connectivity technology, there will be pressure for the industry to shorten product and service development lifecycles, as disruptive technologies stir upheaval.

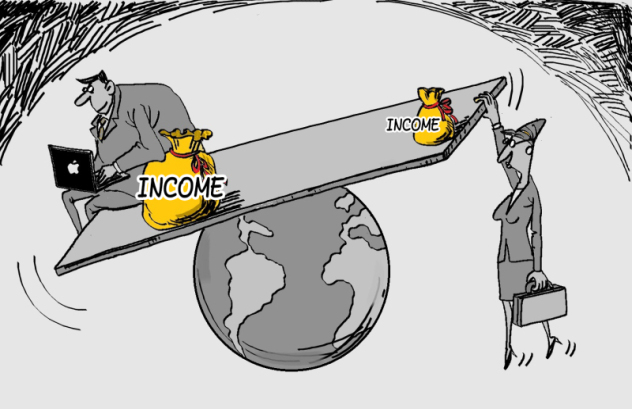

With this backdrop, there are several implications for telecom operators. First, IoT – which by definition enables users to connect to devices at home and work – will no doubt be voracious in consuming bandwidth. A study by Cisco estimates that 67 percent of all Internet traffic will be from Wi-Fi and mobile networks by 2019; in 2014, this was only 42 percent. While telecom companies must cope with the increasing traffic and demands on bandwidth, they must remain profitable. To do so, they must continually invest where profitable customers are and study the services demanded, but also balance that with expansion of coverage to grow user base.

A second consequence in the rise of IoT adoption is that telecom operators are likely to forge even closer ties with equipment makers. While cooperation in the past two years has focused on joint investments into research and technologies, cooperation could be forged in other IoT areas like human capital development and patenting. They could also look at ways of incubating and accelerate startups.

Third, there is high likelihood that acquisition activities in the telecom industry will continue to thrive, expanding to target IoT makers. If history is indicative of the future, telecom operators may continue to favor acquisition as a means of growth. In 2015, deals involving Chinese companies reached a whopping $806 billion at more than 5,000 deals, a size 10 times larger than second place South Africa, which had $52 billion worth in deals. Of the 5000-plus deals in 2015, about 10 percent or 546 deals were telecom- and mobile-related. To date, no other deals in China have topped PCCW's acquisition of Cable & Wireless Hong Kong in 2000, worth $38 billion. And of the 10 biggest deals in China, six were telecom-related. Based on the active acquisition history of the telecom players, there could be industry shakeups in terms of vertical integration by telecom companies.

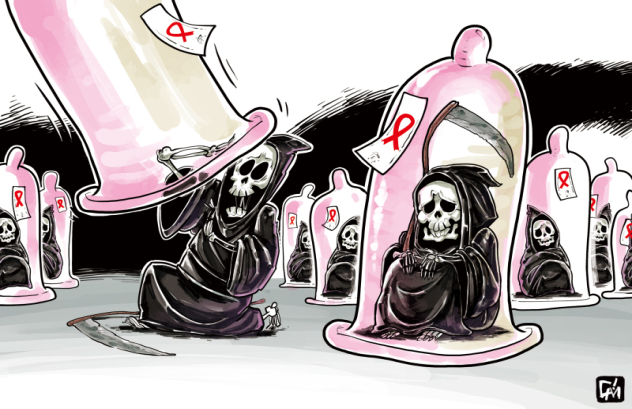

However, as IoT adoption becomes more prevalent, telecom companies can yet again come face-to-face with the ongoing challenges of disintermediation and becoming a dumb pipe. The control over IoT devices will rest with their manufacturers, proprietary platforms and eventually, customers. This multitude of closed ecosystems, unregulated interfaces and a race to produce devices cheaply, has led to lax security implementations by the device manufacturers. Recently, hackers took control of swarms of IoT devices and brought down critical Internet infrastructure, by flooding them with excessive traffic, also known as DDoS (Distributed Denial of Service) attacks.

In this threat, lies another opportunity for the telecom companies, to reestablish their position as the safekeepers of global networks. Operators should strongly be looking at investments into building security services and products, especially today where networks and systems are also evolving and virtualizing at a frantic pace.

These developments pave a clear opportunity for operators to take an active role in fostering greater societal adoption, drive innovation as well as build and maintain industry and security standards, which would ultimately augment the quality of life in China.

Mr. Dujacquier and Mr. Gidwani are Senior Partner and Principal at Roland Berger, a consulting firm with offices in Hong Kong.