Move to attract more global investors

|

|

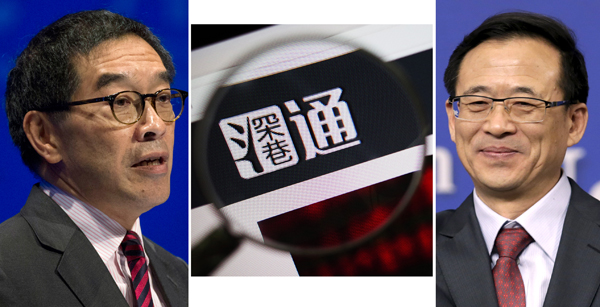

Hong Kong Securities and Futures Commission Chairman Carlson Tong (left) and Liu Shiyu, chairman of the China Securities Regulatory Commission (right). The State Council has given the green light to a long-awaited plan to connect the Shenzhen stock exchange with Hong Kong's, further opening up China's capital markets. BY REUTERS/XIAO MU/CHINA DAILY |

One after another, measures are being taken to promote the trading links between the capital markets on the Chinese mainland and in the Hong Kong Special Administrative Region and take effective action against illegal activities.

The launch of the Shenzhen-Hong Kong Stock Connect on Monday signals not only the extending of mutual access to the mainland and Hong Kong stock markets but also the further strengthening of cooperation between the China Securities Regulatory Commission and the Hong Kong Securities and Futures Commission to maintain market order and protect investors.

Similar to their arrangements for the Shanghai-Hong Kong Stock Connect, the first channel allowing mutual access for eligible investors that has been operating smoothly since it was officially launched in November 2014, the two regulators have agreed and signed a memorandum of understanding on the principles and arrangements for their regulatory and enforcement cooperation to protect the integrity of both markets, including real-time surveillance by the two watchdogs of the activity in their respective markets. And with contingency plans in place for various eventualities and the two stock exchanges and the clearing houses having completed a series of market rehearsals, both regulators are confident the system is good to go.

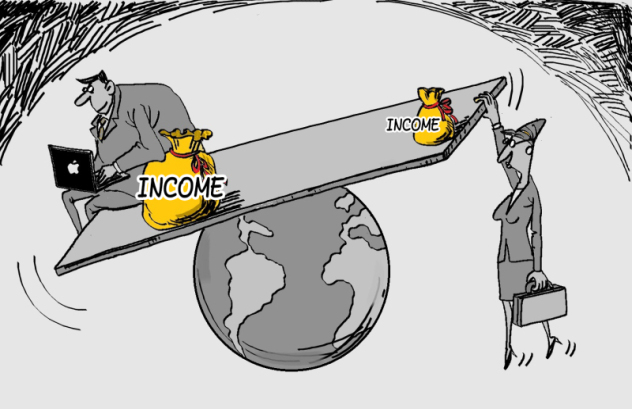

Not only will the Shenzhen-Hong Kong Stock Connect help reinforce Hong Kong's role as an international financial center once it is launched because it will "help globally deploy Chinese investors who are the last residual pool of capital in the world today" as Charles Li, chief executive of Hong Kong Exchanges and Clearing, has said. It should also serve to boost global investors' confidence in investing in the mainland market.

For while the Shanghai Stock Exchange is dominated by State-owned giants such as Sinopec and the mainland's big banks, and trading through the Shanghai-Hong Kong Stock Connect program has been somewhat lackluster, many of China's most successful and innovative technology companies and service providers are listed on the Shenzhen Stock Exchange and it has consistently been the mainland's best-performing market for a while now.

Concerns about the lack of market accessibility was one of the reasons cited by MSCI for not including the Chinese stock market in its widely tracked emerging-market index, although it did note the Chinese authorities have made "significant improvements" in accessibility for global investors.

The launch of the Shenzhen-Hong Kong Stock Connect shows the government is continuing to make progress toward removing barriers for international investors to directly tap the mainland market, as it is giving them access to trade on what is the world's seventh largest stock market by value and the second busiest after the New York Stock Exchange.

And to further enrich the variety of traded products and provide more investment opportunities and convenience for domestic and overseas investors, the China Securities Regulatory Commission and the Hong Kong Securities and Futures Commission have reached a consensus on including exchange-traded funds as eligible securities under the mutual market access scheme, with a launch date to be announced separately after the Shenzhen-Hong Kong Stock Connect has been in operation for a period of time and certain conditions satisfied.

The launch of the Shenzhen-Hong Kong Stock Connect represents another step toward realizing goal of a law-regulated capital market with international features.

The author is a senior editor with China Daily.

- Shenzhen-Hong Kong Stock Connect officially starts

- Hong Kong helps reinvent quake-ravaged Sichuan

- China to waive capital gains tax for Shenzhen-Hong Kong Connect

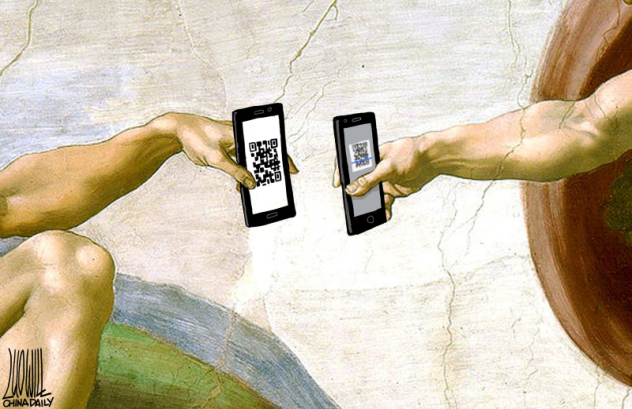

- Hong Kong must look beyond mobile payments to benefit from fintech

- Report: Mainland visitors key to Hong Kong retail

- Hong Kong's property market resilient enough to take on mild rate hikes