Why are foreign nations dumping US treasuries?

|

|

A Chinese clerk counts US dollar banknotes over yuan notes at a bank in Huaibei, East China's Anhui province, Jan 22, 2015. [Photo/IC] |

Recently, foreign holders of US treasuries have been dumping their holdings more and at record pace. Optimists see it as a temporary fluctuation. Realists warn about structural change.

According to US Treasury data, major foreign holders of US treasury securities have been reducing their holdings by almost $250 billion since March. The pace of dumping has intensified with some $200 billion reduced in just past two months.

In the process, Japan has surpassed China as the major holder of US treasuries for the first time in nearly two years. While the mainland still has some $1.16 trillion in US treasuries, it has reduced its holdings by $130 billion in just a year, along with Saudi Arabia ($18b), Russia ($13b), Turkey ($9b), and Norway ($18b).

What’s going on?

Temporary glitch or structural change

While some argue that the reductions by foreign holders only reflect seasonal fluctuations, this may no longer be true. Until recently, foreign holdings of US treasuries climbed steadily peaking at $6.280 trillion last June. Since then, they have declined by almost 4 percent (or $240 billion).

Indeed, some observers argue that US treasuries have never been sold so aggressively over a 12-month period.

The most benign scenario is that foreign holdings of US treasuries have plateaued since June 2014 when they first crossed the $6 trillion milestone. The less-benign scenario is that these holdings began a decline last summer – when president-elect Trump won the Republican nomination.

The plunge of US treasuries to less than $6 trillion by January 2017 – especially if the rapid pace of dumping will prevail – would further reinforce such perceptions.

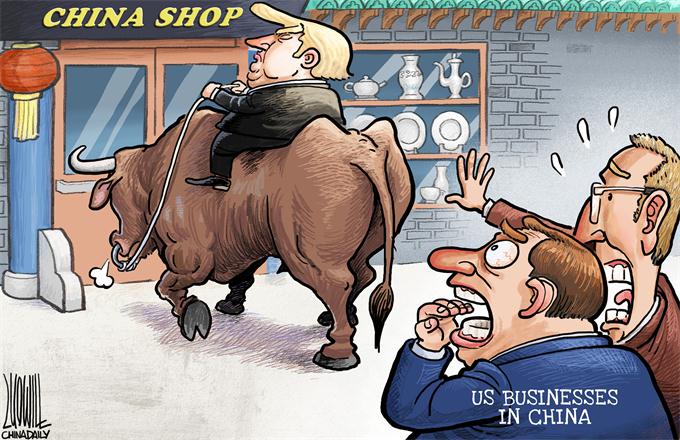

There are obvious reasons for some foreign countries to reduce their holdings. China has been selling holdings to defuse sharper devaluation of the renminbi. Other major sellers – Saudi Arabia, Russia and Norway – are oil exporters, which have sold US treasuries to gain funds to offset the drop in dollar-denominated oil prices and to contain the deterioration of budget deficits.

Some sellers – Saudi Arabia, Russia and Turkey – also struggle with geopolitical challenges that are forcing them to reassess the weight of the US dollar and US ties in their foreign economic relations.

Finally, all foreign holders are concerned that the Trump administration will soon initiate its fiscal stimulus, which could almost certainly translate to a major spike in future debt issuance by the US.

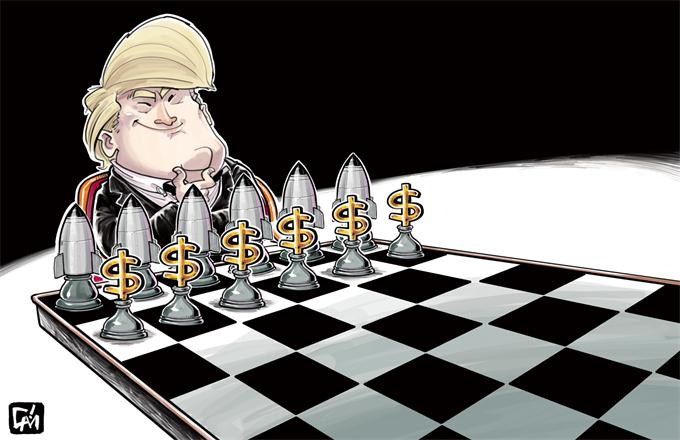

Trump’s debt tornado, Fed’s hikes and treasuries

The net effect of foreign selling of US treasuries, especially if it does not slow in the next few months, looks increasingly like the kind of foreign liquidation that Washington has feared for years. Moreover, it may push the Fed into a corner.

If Trump will trigger a $1 trillion debt tornado at a moment, when Fed chief Yellen and her board seek to accelerate tightening – in addition to recent 25 basis points hike, three comparable rate increases in 2017 – Trump can no longer rely on the Fed to ease and thus to monetize the debt issuance.

While Trump has said that he would like to replace Yellen because she is not a Republican, her term will not end until February 2018. Last June, Trump characterized Yellen as "a low interest rate person,” like himself. "If we raise interest rates and if the dollar starts getting too strong, we're going to have some major problems,” he warned. That shift is now a reality.

Moreover, as Trump is about to dramatically polarize Washington, America and the world community, he will force Yellen to draw contingency plans (including halting rate hikes, initiating a fourth wave of quantitative easing, and so on).

If Trump takes that path, he may incentivize foreign holders of US treasuries and the international community to reassess the weight of US treasuries and US dollar in the world economy even faster than anticipated.

Dr Steinbock is the founder of Difference Group and has served as research director at the India, China and America Institute (USA) and visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore). For more, see http://www.differencegroup.net/

A slightly shorter version of this commentary was originally published by Shanghai Daily on December 20, 2016.