Foreign exchange reserves 'adequate'

Reduction of US Treasuries 'not strategic', says official; confidence in keeping yuan stable cited

China's foreign exchange reserves, which have dropped to about $3 trillion from a peak of nearly $4 trillion two years ago, are currently adequate, said a State Administration of Foreign Exchange official on Thursday.

China's reduction of US Treasury securities holdings, meanwhile, is not a strategic move, since US Treasury securities are the most important investment portfolio in the international market, said the official, who declined to be named.

The official said that "$3 trillion is, at least seen from the current situation, adequate".

In the future, China's scale of foreign exchange reserves might fluctuate around certain levels, given uncertainties caused by changing domestic and international economic situations, which is normal, she said. The administration will prudently use its expertise to manage the money, the official added.

China's holdings of US debt fell to $1.12 trillion at the end of October, the lowest level in over six years, according to US Treasury Department data.

China unloaded a total of $41.3 billion in Treasury securities in October, and Japan replaced it to become the largest holder of US debt, triggering market speculation that China is dumping its dollar assets.

"The cutting is not strategic," the official said. "All countries take the US Treasury securities as an important target for their foreign exchange reserve investment, and China is no exception."

"In investing in US Treasuries, we take into consideration a package of factors, such as the interest rate hike by the US Federal Reserve and the changes in yields, and based on that, we make dynamic adjustment to our holdings," she said. "Such an adjustment should not be interpreted as a strategic move."

Also on Thursday, Ma Jun, chief economist of China's central bank, said China is confident of keeping the yuan "basically stable at a reasonable equilibrium level", despite the fast depreciation of the currency against the dollar since November.

The yuan's central parity rate was 6.94 against the US dollar on Thursday. It was about 6.77 in early November.

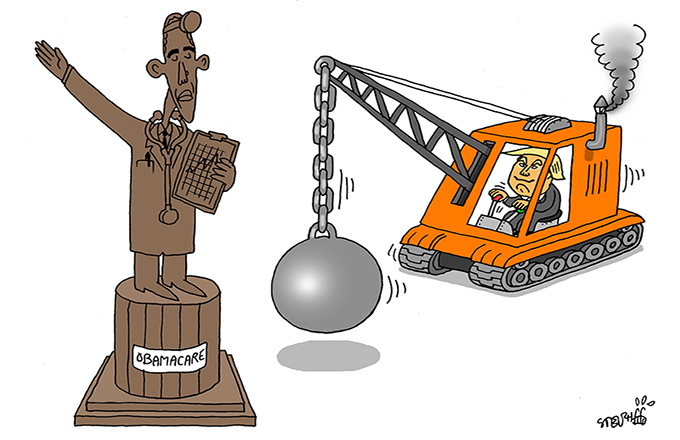

The depreciation is mainly caused by the strengthening of the US dollar, said Ma. The market has expected US president-elect Donald Trump to launch infrastructure investment programs, which would lead to fiscal stimulus and rising inflation, ultimately causing more interest rate hikes and dollar strengthening.

However, Ma said such expectations may be "too optimistic".

"The dollar index may encounter correction, and once that happened, other currencies would rise against the dollar."

xinzhiming@chinadaily.com.cn

(China Daily 12/23/2016 page1)