Interventions paving way for yuan reforms

|

|

An employee counts yuan banknotes at a bank in Huaibei, Anhui province, June 22, 2010. [Photo/Agencies] |

The yuan has depreciated in recent times. In the short term, interventions will prevail, but in the longer term, the Chinese currency will stabilize. In the last quarter of 2016, the yuan declined 4 percent, significantly faster than anticipated, because of rising tensions in foreign exchange markets over China's rising debt and bubbling property market .

China has managed to stabilize growth, but not without capital controls, hefty lending and interventions.

Only days ago, the yuan soared against the US dollar. By encouraging Chinese banks to withhold funds from other banks, the People's Bank of China might have tightened liquidity in Hong Kong, which led the overnight lending market to surge from 17 percent to 61 percent in two days, which in turn caused the yuan to soar in the offshore market.

Nevertheless the efforts to stabilize the currency, China's foreign exchange reserves fell to $3 trillion last month; the lowest since spring 2011.

Three years ago, the yuan was still close to 6.00 per dollar. As China's economic growth decelerated, debt taking continued and the US Federal Reserve began rate hikes, the yuan weakened to 6.95 per dollar in 2016. As it recently got close to 7.00 per dollar, the central bank moved to support the currency.

As Chinese companies and investors have tried to reduce their yuan stakes and diversify risk, the exchange rate has faced further pressure, prompting the authorities to tighten controls on Chinese companies and investors investing offshore. Thanks to these measures, China's growth has been stabilizing, but at a cost.

During the global financial crisis, China's huge stimulus package boosted confidence, supported the infrastructure drive, and prevented global depression. But excessive liquidity led to speculation in equity and property markets. While the current credit target of 13 percent is twice that of the growth rate, China can no longer rely on credit-fueled growth.

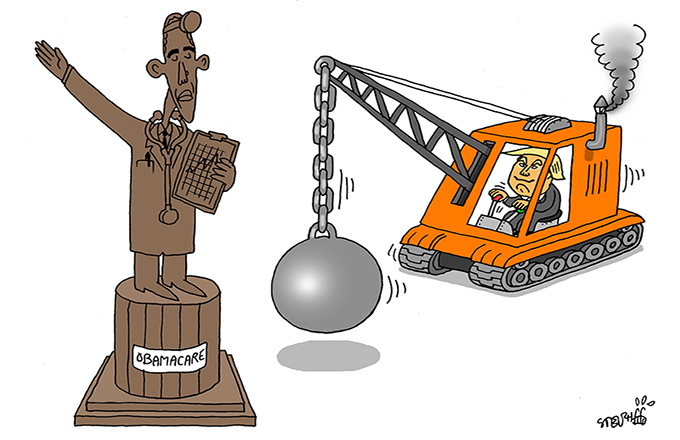

Now China must manage its rebalancing while deleveraging huge local debt. In practice, that means balancing between the yuan's depreciation and actions to defend the currency. After Jan 20, Beijing must also respond to a dual challenge of escalating trade friction with the incoming Donald Trump administration in the United States and rate increases by the Fed.

Pro-market economists have urged the PBoC to let the yuan weaken to an "equilibrium level" before Trump's inauguration. Otherwise, they argue, the PBoC will exhaust reserves to boost the yuan, which will only contribute to destabilization and capital outflows.

However, the proposed reforms will contest the tacit guarantees on State-owned enterprises and State-owned banks, which will cause a fair amount of unease and distress in the short to medium term.

Reforms are necessary to achieve China's rebalancing, which is the government's explicit long-term economic objective, and to double GDP per capita by 2020, which is vital for long-term social stability. The real question is the timing of the reform implementation.

In a benign scenario, within two or three years, the property market will be on a more solid footing, credit target is expected to be significantly lower and quality of growth substantially higher, when the landscape will be more favorable for reform implementation. Meanwhile, the authorities are likely to continue the balancing act between short-term interventions and long-term objectives.

Besides, the yuan-dollar relationship is shifting. In the past, the markets used the volatility index as the barometer for risk appetite and leverage. After the global financial crisis, the dollar has replaced the volatility index as the "new fear index". Indeed, the yuan is coping with not just a strong dollar but also elevated volatility induced by the greenback.

Consequently, the yuan's challenges will intensify in the short term but stabilize in the medium term. With the dollar, the trend may be precisely the reverse.

The author is the founder of Difference Group and has served as research director at the India, China and America Institute (USA) and visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Centre (Singapore).

- Yuan steadies as central bank's remedies take hold

- China's new yuan lending expands in December

- China to invest 1.2 trillion yuan in information infrastructure

- China's tourism spending to hit over six trillion yuan in 2017: Report

- China revises 2015 GDP to 68.91 trillion yuan

- Chinese yuan weakens to 6.9262 against US dollar Monday

- Healthy realty sector vital to yuan stability