Tighter monetary policy would help stop speculation by SOEs

|

|

Models of residential buildings are seen at a sales center in Zhengzhou, Henan province, September 23, 2016.[Photo/VCG] |

AS EARLY AS 2010, the State-owned Assets Supervision and Administration Commission issued a document that required the majority of State-owned enterprises under the supervision of the central government to exit from the real estate sector. However, seven years have passed and SOEs are increasingly active in the realty market. Beijing News comments:

During 2016, real estate prices in metropolises such as Beijing and Shanghai continued to rise. One after another, new plots of land fetched record prices at auction. That in turn has pushed property prices increasingly higher because the cost of the land accounts for a large proportion of a development's price.

Some analysts have blamed central SOEs because they purchased over half of the "land king" plots. That might have its own logic, but the job now is to analyze how it happened. Why did the SOEs rush into the realty market to buy land despite being restricted from doing so by the State-owned assets commission?

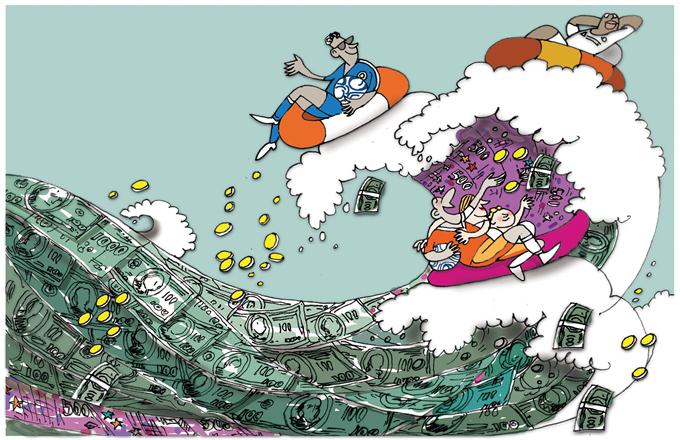

The answer lies not in the real estate market, but in the financial sector. As Zhong Wei, a professor from Beijing Normal University, has pointed out, the rising real estate prices have much to do with inflation. For years, economic scholars and experts have been calling for stimulus policies and looser monetary policies, which gave the market a signal about inflation. When people know large quantities of new banknotes are being printed, they will naturally rush to the realty market. When enterprises sense that, they naturally invest in real estate. SOEs have the most convenient access to market information and they get a large share of the new liquidity. As a result, they are able to make high bids at land auctions and become "land kings".

We do not mean to defend the SOEs that broke the SASAC rule. Our point is that the root problem lies elsewhere. Even if the SOEs leave the realty sector as the order requires, as long as inflation continues and the realty market grows wildly, they will, like all other enterprises, find other ways of investing in it.

Therefore, in order to cool the fever in the realty market and prevent more "land kings" from emerging, what the authorities need to do is tighten the monetary policy and bring inflation to a halt, so that both State-owned and private enterprises will invest rationally in other sectors.