Why White House versus Fed leads to uncertainty

To implement his US$1 trillion dollar infrastructure plan, President Trump needs low rates, even though the Fed’s rate hikes will strengthen dollar. That means new uncertainty worldwide.

In his Crippled America (2015), Trump argued that “our airports, bridges, water tunnels, power grids, rail systems — our nation’s entire infrastructure is crumbling, and we aren’t doing anything about it.”

The problem is that as Trump would like to begin his US$1 trillion dollar infrastructure plan, the Fed is about to accelerate rate hikes. Trump needs low rates and weak dollar. Yellen is raising rates and strengthening the dollar. Something has got to give in.

US$1 trillion infrastructure plan

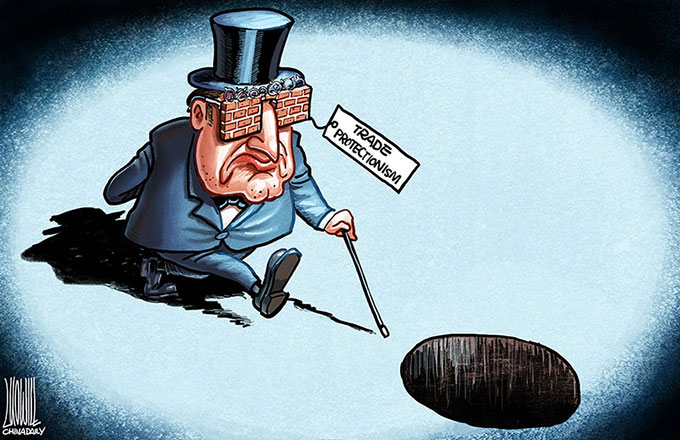

During his campaign, President Trump argued that US economic growth and job creation rests on the combination of income tax cuts, deregulation, trade protectionism and spending for defense and infrastructure. His proposal to boost defense-related spending by US$54 billion suggests that he is about to move ahead.

Trump’s newly-confirmed secretary of commerce, billionaire Wilbur Ross, and the head of National Industrial Policy Commission, Peter Navarro, believe that increased economic growth would be stimulated by income tax cuts and additional military and infrastructure spending, which would offset increased budget deficits.

While there is a longstanding bipartisan agreement on the need for the modernization of the US infrastructure, there has been little consensus about how to go about it.

During his campaign, Trump proposed to spend US$1 trillion to repair and improve the US infrastructure. To raise capital, he hopes to create an infrastructure fund supported by government bonds that investors and citizens could purchase, similar to Build America Bonds.

Nevertheless, realistic analysis of the Trump plan suggests it would cause the national debt to increase by almost US$10 trillion over a decade; on top of the current US$20 trillion which already accounts for 107 percent of the US GDP. That would translate to a debt tsunami.

When Trump’s infrastructure plan was developed, interest rates were still close to zero. But as the Fed is about to hike up the rates, the plan will be a lot more expensive to execute.

In December 2015, the US Federal Reserve raised the interest rate by 25 basis points. It was the first step away from the zero-bound interest rate policy since 2008. In the current year, the Fed seeks to accelerate tightening with three comparable rate increases, even as Trump is about to unleash his US$1 trillion debt tornado.

“If we raise interest rates and if the dollar starts getting too strong, we’re going to have some major problems,” Trump warned in June 2016.

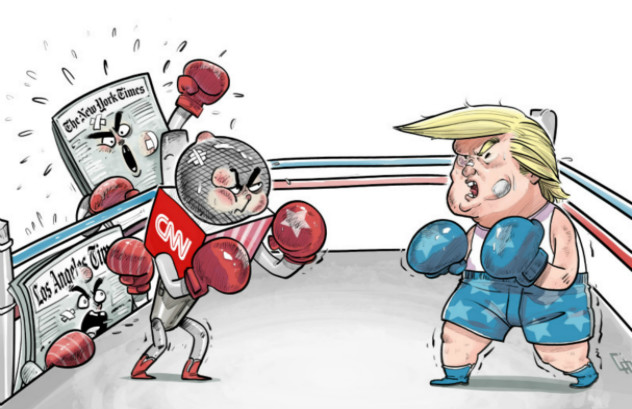

That shift is a reality now. He can no longer rely on the Fed to ease and thus to monetize the debt issuance. In turn, efforts at aggressive infrastructure modernization could force Yellen to slow down rate increases, keep them lower, or halt such hikes.

At the same time, any perceived stalemate between the White House and the Fed could lead foreign holders of US treasuries to unload their holdings. That’s what happened last year when the US presidential elections got ugly and foreign holders of US treasury securities reduced their holdings by US$250 billion.

Increased uncertainty about the contradictory objectives of the Fed and the White House could result in a new wave of dumping.

More volatility

What’s at stake is also the value of the US dollar. Fed’s rate hikes tend to strengthen the dollar, while Trump’s debt tsunami would weaken it.

US dollar’s recent fluctuations reflect uncertainty about the administration’s contradictory objectives, even as the US dollar has replaced the volatility index as the new “fear index.”

The timing is not favorable as the Trump administration is about to accuse its key trade partners — China, Germany, Japan and Mexico — for “unfair trade” and “currency manipulation.”

The new economic uncertainty and market volatility is only about to begin.

Dr Steinbock is the founder of Difference Group and has served as research director at the India, China and America Institute (USA) and visiting fellow at the Shanghai Institutes for International Studies (China) and the EU Center (Singapore).