AIIB is recharging globalization

|

| SHI YU/CHINA DAILY |

The emergence of the Asian Infrastructure Investment Bank has had two major global implications. The first is in terms of additional availability of finance for regional infrastructure development. Traditional financial institutions such as the International Monetary Fund, World Bank, Asian Development Bank and the African Development Bank have been funding multiple development projects in many countries.

The AIIB complements the existing avenues of multilateral project finance by creating a corpus of funds specifically for infrastructure development. Infrastructure is the most important economic need of most countries, particularly those in Asia. The significance of the AIIB for Asia in this respect is easily understood.

The second major implication of the AIIB is a re-ordering of the global balance of power around itself. Developed countries of the West have traditionally dominated global financial institutions like the IMF and World Bank. And large emerging market economies such as China, India and Brazil have been unhappy with the traditional financial institutions because their roles in the decision-making of the IMF and World Bank are small compared with the current sizes of their economies.

The AIIB is a major change in this respect. Led by China, it has evolved as an international financial institution that aims to give much greater space to emerging markets in institutional decision-making and project financing. In the process, it has attracted countries that are willing to contribute to a global financial architecture led by China.

While the AIIB has moved forward on the lines of a multi-country initiative, there is little doubt about the leadership that China has been providing. Given China's rapid economic growth for more than three decades and the geostrategic influence it has acquired as a result of that, China is now a major power and a prominent global player. Any initiative led by China, even if for economic development through infrastructure building, is bound to raise questions about the country's strategic interests. The AIIB, too, is bound to face such questions.

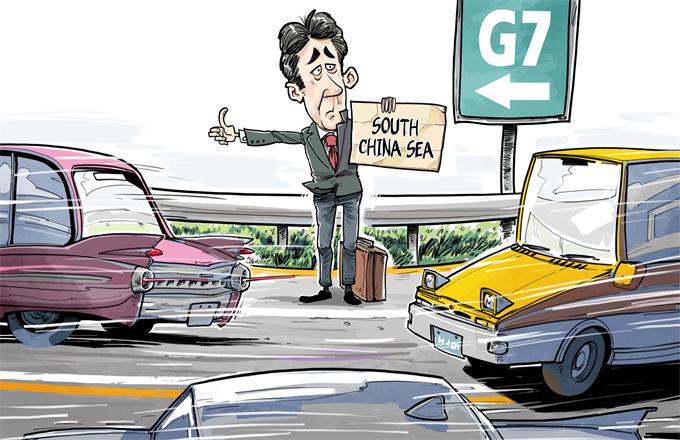

The success of the AIIB, till now, is based on moving forward despite being labeled by many as an initiative by China to expand its global strategic influence. But more and more countries have been joining the AIIB, and its members include several countries that are prominent players in the IMF and World Bank. Some of these countries are also defense and strategic allies of the United States. Obviously disturbed by the AIIB's increasing influence, the US has been trying to persuade its allies to stay away from it.

However, several US allies, including major economies such as Australia, France, Germany, the United Kingdom, and most recently Canada, have joined the AIIB. The mostly non-regional commitment of these major economies to the AIIB is indicative of the bank's positive appeal to the global community as a financial institution. In this respect, these countries have not hesitated to irk the US in choosing to join the AIIB. Such a choice by several US allies reflects the flexibility these countries wish to have when making strategic decisions.

The issue of choice for most major economies also point to the emergence of another narrative around the AIIB. Its commitment to infrastructure building is expected to be a trigger for generating fresh economic momentum at a time when many countries face slower or zero economic growth because of the rising trend of anti-globalization and protectionism. Indeed, in this context, the AIIB can be seen as a forum and initiative for taking forward globalization.

While globalization is experiencing a backlash in the developed world, developing countries and emerging markets still support free trade, because they believe it brings considerable benefits. The AIIB can be useful in this respect, by funding infrastructure projects that increase the capacities of its member countries to participate in global trade through lasting value chains. As such, much of the goodwill enjoyed by the AIIB is because of the gains it can bring for recharging globalization.

The author is a senior research fellow at the Institute of South Asian Studies, National University of Singapore.