Reforms can fortify old-age insurance plan

China has established an institutional old-age insurance framework covering workers and residents. The employees' basic pension insurance system combines social funds and personal accounts for 380 million workers nationwide. It has also established a basic old-age insurance system that covers 500 million urban and rural residents.

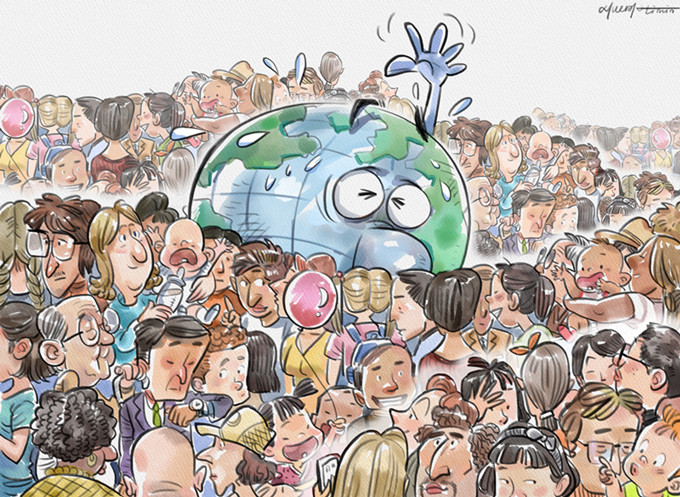

Together, the two old-age insurance plans cover 880 million people. Based on the estimation that China has about 1 billion people above the age of 16, the country's old-age insurance plans' coverage rate is about 88 percent.

In 2008, the accumulated balance of the two old-age insurance funds was 992.5 billion yuan ($149.07 billion), which increased to 4.40 trillion yuan last year, indicating the strong payment capacity of old-age insurance funds. Although in some provinces and regions the growth rate of basic old-age insurance funds has been lower than the growth rate of expenditure, the reverse is true in others. Which means the accumulated balance of China's basic old-age insurance funds will continue to rise.

The basic pension insurance funds of enterprises play a dominant role in the funding of China's basic old-age insurance system. According to last year's data, even if the authorities were to stop collecting old-age insurance premium today, the existing old-age pension funds could still pay pension nationwide for more than 17 consecutive months. Hence, experts generally believe China has enough capacity when it comes to paying old-age pension.

As the balance of national basic old-age insurance fund has risen to more than 4 trillion yuan, there is no reason to fear about a shortage of pension insurance funds. But this assurance should not stop the authorities from taking measures for the sustainable and healthy development of the basic old-age insurance system.

China's aging society, increasing pressure of economic downturn and slowing growth rate of fiscal revenue mean it will face rising payment pressure on its pension insurance fund in the future. But the authorities have taken several measures to cope with this pressure.

First, they have established a national social security strategic reserve fund with a market value of 2 trillion yuan to supplement employees' basic pension insurance funds and cope with the subsequent pressure of pension payment necessitated by a rapidly aging society.

Second, they have also established an investment mechanism for employees' basic pension insurance funds, in order to preserve and increase the value of pension insurance funds.

Third, they have allocated partial State-owned capital to make up for the cost of transforming the pension insurance system.

And fourth, the central leadership has asked governments at all levels to take up the responsibility of paying full old-age pension in time.

Now, the authorities should further improve the basic pension insurance system for employees. Social pooling should be raised from the provincial to the national level so as to create a fair competition environment for enterprises and correct the imbalance among provinces and regions. Also, the authorities should gradually raise the retirement age, unify pension insurance premiums, and take necessary measures to solve the problems related to the premium payment period.

In other words, although the old-age insurance system is improving and the old-age insurance fund is being effectively operated, reforms in the sector should be deepened and active measures taken to guarantee the sustainable and healthy development of the system.

The author is director of the Social Security Research Center affiliated to the Central University of Finance and Economics.