Pension reform to benefit senior citizens

|

|

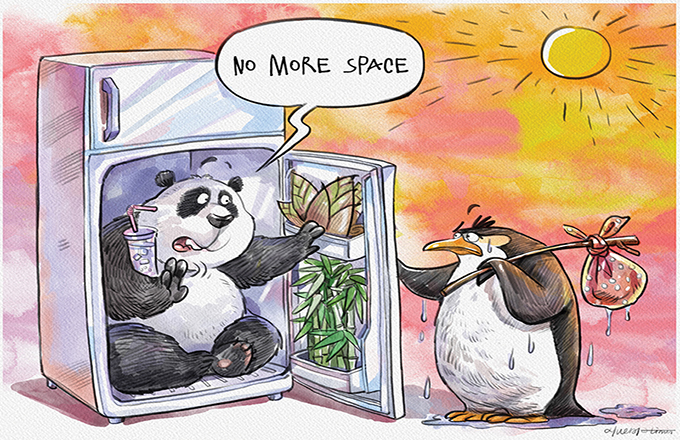

Senior citizens chat at a retirement home in Beijing. [Photo/Xinhua] |

|

|

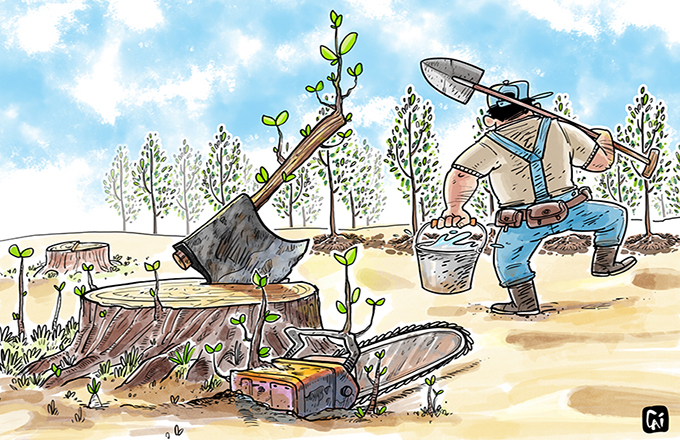

Yang Yansui [Photo/China Daily] |

The pension reform, as part of the comprehensive reforms launched by President Xi Jinping, is aimed at improving people's well-being. The comprehensive reforms also show the central leadership, led by Xi, is committed to improving people's livelihoods.

Thanks to the pension reform, by the end of last year, China had in place an institutional old-age insurance framework covering 380 million employees nationwide, and a basic pension insurance system covering 500 million urban and rural residents.

Besides, the accumulated balance of the pension insurance fund increased from 99.25 billion yuan ($14.71 billion) in 2008 to 4.40 trillion last year, and the authorities have taken several measures, including investing the basic pension insurance fund and allocating State-owned capital to the national pension insurance fund, to improve the pension system.

By 2025, when China is expected to enter a deeply aging society, the ratio of the population paying pension premiums and those receiving pensions will be about 2.5:1, which will decline further in the future. The growth rate of the basic pension insurance fund expenditure is now higher than the income, which is unlikely to change in the near future given the aging population trend in China.

A major problem in an aging society is the conflict of interests among generations, which becomes increasingly intense with working-age people being made to pay higher taxes to help sustain the basic pension fund. So the authorities should strike a balance between employment and pension, and income and expenditure of the pension fund. Which makes adjustment of the pension structure an important task for the authorities.

According to last year's data, China has enough pension fund to pay old-age pension nationwide for more than 17 consecutive months, reflecting the fund's stability. But since China will become a deeply aging society by 2025, the authorities have to comprehensively reform the pension system in eight years.

First, they have to build a large enough basic pension fund to maintain social stability and fairness. For which, they have to consolidate the payment base of pension insurance fund, adjust the pension rate to make clear the extent of the responsibilities of the State, enterprises and individuals, extend social pooling of pension insurance fund from the provincial to the national level, raise the retirement age, and improve the national social security reserve fund system.

Second, the authorities should encourage all employers, including enterprises and government institutions, to pay supplementary pension to their retired employees. Raising the value of pension fund of enterprises through channels such as investment is very important given the rising labor cost and intensifying competition among enterprises. The financial capability of public institutions to pay supplementary pension is limited. So the supplementary pension could be linked to the housing fund, as it would reduce the rate of pension the institutions pay to their employers and thus ease their financial pressure.

Third, the authorities should encourage self-employed individuals to invest in assets, including old-age pension funds, real estate and long-term nursing insurance plans, so that it generates income to sustain them in old age. They should also be encouraged to purchase annuity and old-age nursing insurance. One form of encouragement could be preferential taxation policies for such individuals.

The institutional framework of China's pension system has been improving, and its basic pension insurance fund has remained stable. And its sustainable development will help the authorities establish a unified information system, as well as management and service systems, in order to build a top-level pension system to cope with the pressure of aging society.

The author is director of the School of Public Policy and Management at Tsinghua University.

- China to further promote commercial pension insurance

- Principal eyes huge pension potential

- Fund surplus points to pension security

- China's pension funds see steady growth in Q1

- Pension funds to have low exposure to share markets

- Conservative approach taken on pension funds

- Nation to strengthen pension management