$15b fund to accelerate SOE reforms

( China Daily )

State, private firms to manage special body on mixed-ownership basis

The central government is planning to set up a special fund of up to 100 billion yuan ($15.19 billion) to accelerate mixed-ownership reform by the first half of next year, China Securities Journal reported on Thursday.The fund will be jointly invested by a number of State-owned enterprises and private companies. Each side will hold half of the fund's stock rights to manage it as a mixed-ownership fund, said the report.

The move came after the central government announced earlier this month that it had selected a group of 31 SOEs, under local authorities or the central government, for the third round of SOE mixed ownership reform, aiming to bring more private capital into the State sector. Li Jin, chief researcher at the China Enterprise Research Institute, said the government's next move will be to further promote mixed-ownership reform at local SOEs.

Mixed-ownership reform is designed to further diversify the ownership structure of SOEs, going beyond mergers, acquisitions and reorganization, and has helped improve the efficiency and competitiveness of SOEs directly under the central government.

"As local SOEs face more competition between each As the reform will take place soon, a number of funds backed by State capital have also appeared to support the project across the country.

The China Structural Reform Fund led by State-owned capital joined forces with Industrial and Commercial Bank of China Beijing branch and Beijing Wealth Capital to establish a special fund in August. It aims to invest in mixed-ownership reform and the restructuring of central and local government-controlled enterprises.

A similar fund was set up by Yangquan Coal Industry (Group) Co and Beijing-based Phoenix Tree Capital Partners, which jointly launched a 10 billion yuan mixed-ownership reform fund in Taiyuan earlier this month, the first in northern China's Shanxi province, while such funds have also appeared in Beijing, Shenzhen, Shanghai and Guangzhou.

Wang Wen, executive dean of the Chongyang Institute for Financial Studies at Renmin University of China, said these specific funds are vital to expand capital investment and could best use market forces to inject vigor into the new round of SOE reform.

"The fund will promote an overhaul of SOEs, pilot mixed ownership programs, encourage mergers and acquisitions, and downsize overstaffed companies," he said.

"Like central SOEs, local SOEs should also set up a modern company system during the reform process," said Zhu Houlin, a business partner at Beijing-based Zhongjin Guoxu Asset Management Co.

Zhu said the management mechanisms of local SOEs may not be as sophisticated as those of centrally administered ones.

The first two rounds of reform covered 19 SOEs, including China State Shipbuilding Corp and China Unicom. These are gradually implementing restructuring programs and more than a third of them have completed most of their reforms, including introducing new investors, boosting corporate governance and setting up new internal incentive mechanisms.

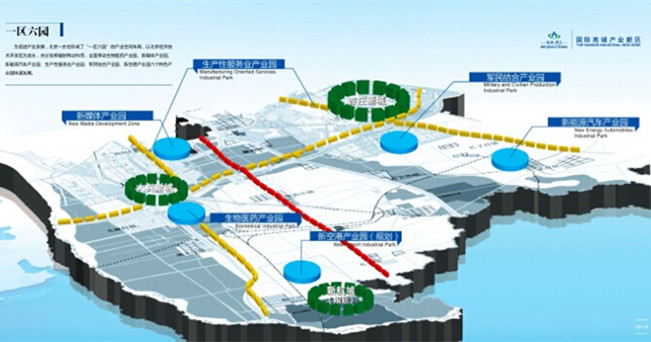

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500