JD Finance fundraising a precursor for IPO

( China Daily )

The reported $2 billion fundraising by JD Finance, the financial arm of China's second-largest e-commerce player JD, could pave the way for the subsidiary's eventual listing, according to experts.

JD Finance is looking to raise capital that could see its value rise to more than $20 billion, online news portal jiemian.com reported. Investors include China International Capital Corp Ltd and State-owned China National Cereals, Oils and Foodstuffs Corp.

The subsidiary declined to comment on the matter.

Last year, e-commerce giant JD completed the spinoff of JD Finance, which was seen as a preparatory move toward its listing on a domestic stock exchange, as well as obtaining more financial licenses.

"JD has ramped up efforts in the internet finance sector and this round of fundraising will have an influence on the future public listing of JD Finance," said Li Chao, a senior analyst at market research firm iResearch.

Li said the company has expanded its presence in supply chain and consumer finance, which are rooted in its online shopping platform, and offered financial services in rural areas.

"It still lags behind its rival Ant Financial Services Group, the financial affiliated of e-commerce giant Alibaba Group Holding Ltd, in the online payment field," Li added.

Ant Financial was spun off from Alibaba and obtained business independence in 2014, making it a powerful financial player.

JD has accumulated abundant business customers through providing credit products and wealth management services, according to Lu Zhenwang, CEO of Shanghai-based Wanqing Consultancy.

Chen Shengqiang, CEO of JD Finance, said in an earlier interview that the company provides enterprise services to financial institutions instead of directly conducting financial business.

Established in 2013, JD Finance offers sophisticated financial solutions, including supply chain finance, consumer finance, wealth management, crowd funding, insurance and securities. The company is applying for financial service licenses as the size of the country's middle-income earners surges.

In 2014, it launched internet credit product Baitiao, which offers users the option to "buy now, pay later". During Singles Day 2015, the number of Baitiao users increased 800 percent compared to that in 2014.

In January 2016, JD Finance raised 6.65 billion yuan ($1.05 billion) from investors such as Sequoia Capital China, China Harvest Investments and China Taiping Insurance.

Last month, JD announced it will invest 536.6 million yuan for a 33.3 percent stake in global insurance giant Allianz SE's China unit, furthering its push into the financial sector.

fanfeifei@chinadaily.com.cn

(China Daily 05/16/2018 page16)

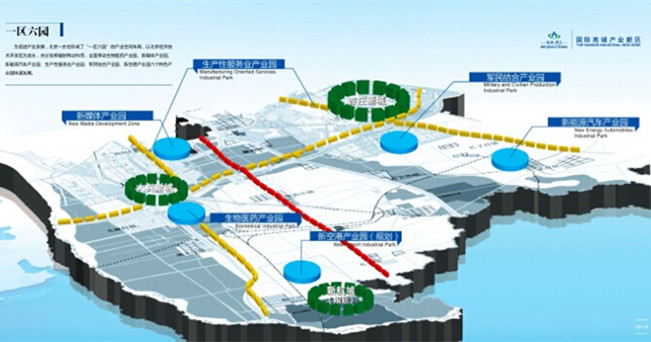

The Area with Six Parks

The Area with Six Parks Global Top 500

Global Top 500