US Fed poised to cut rates again

Updated: 2008-03-18 16:28

WASHINGTON - The Federal Reserve is expected to aggressively lower interest rates in its intensified battle against the credit crisis and spreading economic weakness. The question is whether all of the effort will turn the tide.

|

|

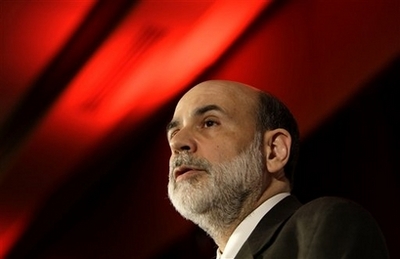

Federal Reserve Chairman Ben Bernanke and his colleagues have already been working overtime, employing a variety of novel approaches to keep the economy out of a recession or at least moderate the impact of any downturn.

More relief is expected Tuesday when the central bank is expected to cut a key interest rate by between one-half and a full percentage point.

"There is no reason for the Fed not to be aggressive," said Mark Zandi, chief economist at Moody's Economy.com. "The economy is in a recession, the financial system is in disarray and inflation is low."

Many economists believe the Fed will deliver another three-quarter-point cut or perhaps even a full one-point reduction at Tuesday's meetings because Fed officials will not want to disappoint fragile financial markets, which have been on a rollercoaster ride in recent days as they have watched Bear Stearns Cos., the nation's fifth largest investment house, suddenly be brought down by the equivalent of a run on the bank.

JPMorgan Chase & Co. stepped in to announce it was purchasing Bear Stearns at a fire-sale price on Sunday in a deal helped along with a pledge that the Fed would supply a $30 billion line of credit to back up Bear Stearns' assets.

That offer over the weekend was the latest move by a central bank that has been pulling out all of the stops, including using Depression-era procedures, to pump cash into the financial system. Analysts, who faulted Bernanke for being slow to recognize the gravity of the situation last year, now give him high praise for bringing all the Fed's powers to bear.

"The Fed is doing what it can to come to rescue an economy that faces potentially a huge meltdown in financial markets," said Lyle Gramley, a former Fed governor and now an analyst with Stanford Financial Group. "The Fed is acting as a lender of last resort and being very aggressive and innovative."

|

||

|

||

|

|

|

|