|

|

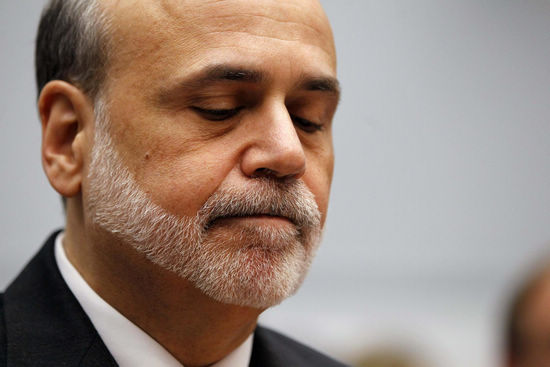

US Federal Reserve Chairman Ben Bernanke reacts as he testifies before the House Committee on the Financial Services semi-annual monetary policy report on Capitol Hill in Washington, in this July 18, 2012 file photo. [Photo/Agencies] |

WASHINGTON - In a long-awaited policy speech on Friday, US Federal Reserve Chairman Ben Bernanke hinted that the central bank might provide further monetary easing steps to improve the US labor market and broader economic recovery.

The stagnation of the US labor market was a "grave concern," and the US central bank would provide additional policy support as needed to promote a stronger economic growth, Bernanke said while addressing central bankers and economists at the Federal Reserve Bank of Kansas City Economic Symposium, held in Jackson Hole, the US state of Wyoming.

"The rate of improvement in the labor market has been painfully slow," Bernanke said at the annual meeting, adding that the US unemployment rate has remained more than 2 percentage points above what most Fed policymakers see as the longer-run normal level.

The jobless rate edged up 0.1 percentage point to 8.3 percent in July from the previous month, figures from the US Labor Department showed.

The US economic recovery was "obviously far from satisfactory, " adding that "unless the economy begins to grow more quickly than it has recently, the unemployment rate is likely to remain far above levels consistent with maximum employment for some time."

At the end of every August, central bankers and economists gathered at the high-profile meeting in the Rocky Mountains to discuss global economic developments and monetary policies.

During Bernanke's remarks at this symposium in August 2010, he hinted that the central bank might begin a second round of assets purchase, or QE2. The Fed did start the bonds-buying program three months later.

Bernanke defended the Fed's monetary policies over the past years, including interest rate cuts and two rounds of assets purchase, aimed at stimulating the US economy. He said studies showed that these policies have helped create more than 2 million jobs.

Since the onset of the financial crisis, the Fed has completed two rounds of quantitative easing, known as QE1 and QE2. It has bought more than 2 trillion dollars of Treasury securities and mortgage-backed securities, expanding its balance sheet to around 2.9 trillion dollars and attracting sharp criticism both at home and abroad.

"The unusual severity of the recession and ongoing strains in financial markets made the challenges facing monetary policymakers all the greater," Bernanke contended.

Bernanke also downplayed the potential risks from the Fed's unconventional moves, saying that costs of carefully-designed nontraditional policies including QE appeared "manageable."

He stressed said that Fed policymakers "should not rule out the further use of such policies if economic conditions warrant."

Investors were watching Bernanke's remarks closely to find guidance on new monetary measures to speed up the recovery. US stocks climbed on Friday after the speech, as investors believed that another round of monetary stimulus was on the way.

Some economists expected the Fed to do more to stimulate the anemic economic recovery as the nation's inflation pressure was muted currently, but some worried that new monetary easing moves from the Fed might push up inflationary pressure in the future.

Monetary policy could not solve all problems. What it could do was to achieve a combination of employment and inflation, Joseph Gagnon, a senior fellow at the Washington-based Peterson Institute for International Economics, told Xinhua.

"It is simply a question of how you trade off employment against inflation. Right now there is no tradeoff-- we want more employment and inflation is low," said Gagnon, a former senior economist at the Federal Reserve.

The Fed's powerful interest setting panel was scheduled to meet on September 12-13 to weigh monetary policy steps to fulfill its dual mandate, namely to foster maximum employment and maintain price stability.