China's Finance Minister Lou Jiwei cautioned the US Federal Reserve to beware of risks to the global financial system after the Fed said that it may quit its quantitative easing policy.

Lou said that China supports the plan but takes no position on when it should be implemented.

|

|

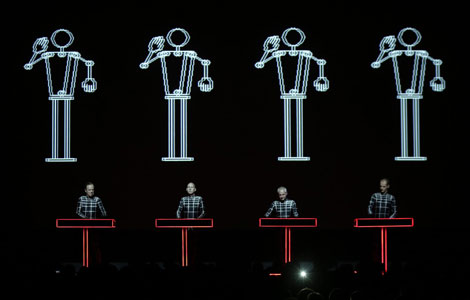

Chinese Vice-Premier Wang Yang (left) and US Secretary of the Treasury Jack Lew wait for a roundtable meeting during the 5th China-US Strategic and Economic Dialogue at the US Department of the Treasury on Thursday in Washington. Brendan SMIALOWSKI / Agence France-Presse |

"We support the considerations of the Fed of its QE exit, but we should pay high attention to the impact of the policy on the international financial system and properly handle the timing, tempo and intensity of its QE monetary-policy exit while guarding against the possible financial risks," Lou told reporters on Thursday during the fifth China-US Strategic and Economic Dialogue in Washington.

"The monetary policy of the United States does not exert impact only on itself, but also has a spillover effect on the global economy," he said.

The minister said China's leadership supports plans by the Fed to end its bond-buying policy known as quantitative easing, or QE, as conditions allow.

He also expressed Beijing's view that although the Fed will abandon the QE policy "sooner or later", the Chinese government would find it difficult "to make a specific comment" on the timing.

"But if measured by the unemployment rate (in the US), which is 7.6 percent, probably it is an earlier exit," Lou said.

He pointed out that developing economies would likely be worst hit by volatility once the policy winds down. Economists said that slower growth, exchange-rate volatility and tighter credit conditions may be caused by investors directing capital to US markets in anticipation of bigger returns from interest-rate increases.

"The impact on China will not be very serious," Lou said, explaining that risk from a QE pullback is limited because China's capital account — the difference between inbound and outbound spending flows — "has not been fully liberalized" and remains largely regulated.

Fed Chairman Ben Bernanke, who during this week's S&ED met with Chinese central bank officials, told a conference of US economists on Wednesday that QE was here to stay for the foreseeable future. He said a "highly accommodative monetary policy for the foreseeable future" would be needed even after the US unemployment rate reaches 6.5 percent.

On Thursday, Yi Gang, vice-governor of the People's Bank of China, reiterated Lou's reassurances about the limited impact on China if the Fed ends its loose-monetary policy.

"We are fully prepared for these kind of risks. China has abundant liquidity and a high reserve-requirement ratio (for banks' short-term lending), so we have an adequate buffer to tackle such challenges," Yi said. "We will take necessary measures to ensure that there is sufficient liquidity in the money market and to maintain stability."