Chinese enterprises are in for the long haul

Updated: 2014-05-02 09:24

By Zhu Ning (China Daily Africa)

Comments Print Mail Large Medium SmallThe changes in China's growth model hold the promise of good things not only for it but also for others

As the US gradually recovers from recession and grows economically and diplomatically again, emerging markets watch China closely and wonder how its performance will affect them.

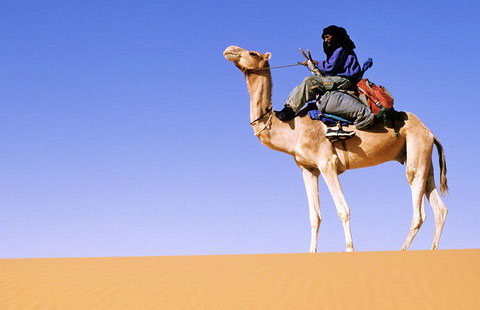

One such market is Africa, as many of its economies are increasingly and inexorably tied to China. In fact, given the close ties between Africa and China that date back to the days of imperial China, the country's increasing influence in Africa should not be surprising, or alarming. In a way, what we are seeing is simply a re-emergence.

In trade with Africa, China has overtaken France and Britain, traditionally the continent's main partners.

In addition to demand for natural resources such as oil, minerals and timber, China sees many African countries as huge markets for its products. But it is a two-way partnership that contrasts sharply with a relationship in which one side simply focuses on the natural resources it can extract from the ground.

More importantly, China has invested huge amounts in Africa in big infrastructure projects such as airports, seaports, railways and roads. Of course, many projects are related to countries and regions rich in natural resources, a key attraction to international capital. But China, more so than others, has provided mutually beneficial investments that make it an increasingly popular investor among African countries.

Fast economic growth in China enables it to afford soft loans and development lending to many African countries, even as ready investment in natural resources is unavailable. This is in stark contrast with most of the loans Western countries and international agencies such as the World Bank provide, usually with many strings attached.

One example is the acquisition by Sinopec, one of China's leading state-owned companies, of oil concessions in Angola, predicated on China's Eximbank advancing credit of $2 billion to rebuild the country's government buildings, hospitals, railways and roads.

This approach is looked on extremely favorably in Africa, and certainly more favorably than the approach the West has usually taken in its dealing with the continent.

The recent slowdown in Chinese economic growth has attracted considerable international attention. The chill has been felt in first-quarter GDP growth, trade growth, and even in real estate sales, all of which have been key contributors to Chinese growth over the past decade.

Some have begun to worry that China's slowdown may dampen its commitment to Africa and hurt the continent's economies. But such worry is unfounded. First, many of China's investments and loans in Africa are long term, so the commercial imperatives to stay to reap long-term rewards are considerable.

Further, many Chinese enterprises have invested in Africa not only at a commercial level but also at a managerial level by building local plants, training local management and transferring management skills to local teams. The potential slowdown in China in the near future may even highlight the importance and promise of Africa in many Chinese companies' leadership. If anything, a slowdown in China may prompt increasing investment and commitment in other promising areas, especially Africa.

Finally, even with a slowdown, China will remain the biggest consumer of natural resources such as oil and minerals, and the growth in Chinese demand will continue to outpace that of other countries. As a result, China will remain Africa's most important trading partner, even in a slowdown.

In fact, as labor costs gradually rise in China and it starts losing some of its international competitive edge in labor-intensive manufacturing, Africa may be given the opportunity to jump start its economy and manufacturing, and switch its over reliance on natural resources to manufacturing and processing. With investment, management know-how and a potential market in China, Africa may be able to turn basic natural resources into manufactured goods, benefiting itself and others.

So transforming the Chinese growth model holds the promise of very good things not only for China, but for Africa as well.

Premier Li Keqiang's visit to the continent coincides with this period of transformation and both sides have much to look forward to during his visit.

The author is a faculty fellow at the International Center for Finance, Yale University; and deputy dean of the Shanghai Advanced Institute of Finance, Shanghai Jiaotong University.

(China Daily Africa Weekly?05/02/2014 page7)