|

| Data from Reuters |

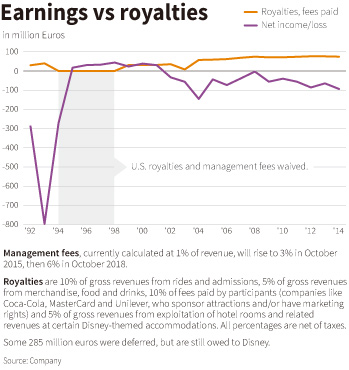

Euro Disney Chief Financial Officer Mark Stead rejects the complaint. Fees, he said, are priced at "market rates" or lower. He pointed to similar fees for Tokyo Disneyland which amount to about 7 percent of its revenue. Disney, which does not own Tokyo Disneyland, would not suspend such charges if a retailer selling its branded products fell on hard times, for instance. Why should it for Euro Disney?

But shareholders say this argument is flawed because Disney, as part-owner of Euro Disney, has a shared responsibility in the firm's financial well-being. Yet Disney charged further fees and even raised them as Euro Disney fell on hard times.

A Disney spokeswoman said the Burbank, California-based firm had "consistently demonstrated its commitment" to supporting Euro Disney and, in addition to waiving fees in the mid-1990s, had deferred payment on some of its fees.

Multinational firms regularly shift revenue between different divisions to minimise the taxes they have to pay. In Euro Disney's case, finance experts and shareholders argue that such transfers have been used primarily to channel revenue to one dominant shareholder over others. Those transfers, as well as management mistakes, have led to under-investment in the French theme park, some shareholders say, hurting visitors' experience.

Broken-down rides, hotels needing renovation, long queues at restaurants and shortened opening hours have dragged down visitor satisfaction, company documents show.

Euro Disney acknowledges the need for new investment. It won shareholder approval on Jan. 13 for a recapitalisation plan to cut debt, renovate the park and set it on a firmer financial footing. The Walt Disney Company, which purchased Euro Disney's debt load from French banks in 2012, says it aims to reduce the 1.7-billion-euro debt to about 1 billion euros and improve Euro Disney's cash position by about 250 million euros.

Virginie Calmels, head of Euro Disney's supervisory board, told shareholders that the strategy would "finally put the firm on the path to profitability."

But some shareholders - there are around 56,000 - no longer trust such assurances.

They are angry that the operation will give the parent company up to 82 percent in Euro Disney. In addition to Disney's stake, 10 percent of Euro Disney's equity is held by Saudi Prince Al Waleed bin Talal, and 6 percent by U.S. investment firm Invesco. Both declined to comment. The rest of the equity is held by small shareholders in Europe.

Under terms laid out in a letter to investors last October, Euro Disney proposes that small shareholders triple their initial investment to keep the same stake proportionally. Alternately, they can sell purchase options for new shares and make a small gain. If they do nothing, they will lose money.

"After so many years of losses the fair thing to do would be to buy everyone out at a decent price," said shareholder Pierre-Alain Le Duc. "Instead they're taking our shares when they are close to their all-time low and securing the rest of the park's equity for a bargain."

"Last stop, everybody off - that's what they're telling us."