Demographic cloud has a silver lining

The booming "silver generation" of China - people aged 65 or above - presents potentially huge opportunities for the insurance industry, an expert says.

"China is undergoing a huge demographic shift, with the proportion of its population older than 65 on track to grow from 10 percent of the total today to 24 percent by 2050," says Domenico Savarese, global head of aging at Swiss Re.

According to the UN, the country's ratio of working-age population to retirees over 65 will decline from 7.7 currently to 3.4 within two decades.

Chinese aged 65 or over are projected to increase from 144 million in 2015 to 330 million in 2050, roughly the current population of the United States and nearly twice the current population of Russia.

The rate of increase in age is more rapid in China than most other comparable countries across the globe.

According to the UN, it has taken China only 34 years for the proportion of its population aged 60 or above to double from 7 percent to 14 percent.

In stark contrast, it took 115 years in France, 85 years in Sweden and 69 years in the US.

"From the perspective of economics, the aging society does have its upside, as tomorrow's 'gray population' in China and around the world could translate into golden consumption and investment opportunities that insurers and reinsurers cannot miss out on," Savarese says.

Some 30 percent of global consumption growth between 2015 and 2030 is forecast to come from the elderly population in the developed world and China. China alone will contribute 10 percent of growth, he says.

With a less mature insurance market and underdeveloped social welfare system, China is known for its much higher level of family support to fund the elderly population, as informal care contributes more than a fifth of the aging wallet, the latest report from Swiss Re shows.

The aging wallet refers to the annual amount spent across State, family and private sectors to fund the lives of the elderly.

Insurance, currently accounting for just 2 percent of the nation's aging wallet, could increase its small share to serve as a complement to such a family dynamic that will not disappear in the foreseeable future, he says.

"The findings highlight the key role that family support plays today, how it could evolve, and how we make ourselves relevant in this game," Savarese says.

Families' large share of the aging wallet fits in well with the country's time-honored culture of "filial piety", under which the younger generation cares for the old, the report says.

However, today's support structure appears to be vulnerable, as Chinese society is embracing structural changes, the report says.

A baby boom in the 1950s that was followed by 36-year-long one-child policy meant the majority of working-age Chinese are the sole providers for their parents and grandparents - not to mention the nation's low fertility and ongoing rural-to-urban migration, which make the vast funding requirements for China's aging society a challenge.

"All of these are pieces of a puzzle that should be considered by policymakers and pilot market players to get a better understanding and vie for a share of the country's promising - albeit yet-to-be-explored - silver economy," Savarese says.

Insurers in China today gain momentum mainly from the sales of health products, while innovations like cancer-only critical illness products also find a place in the market.

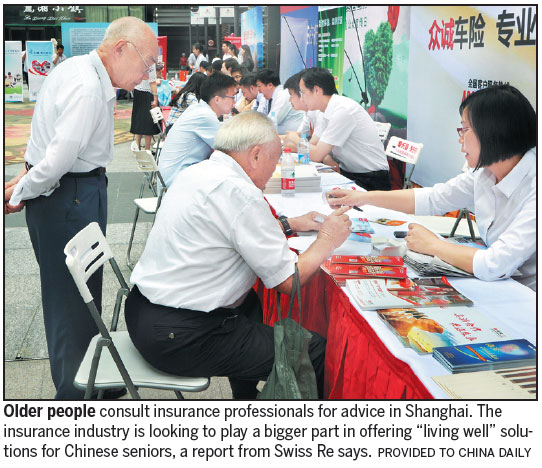

As the insurance sector sees itself as part of a wider ecosystem that enables successful aging, it is looking to play a bigger part in offering "living well" solutions for the country's seniors, the report says.

sophia@chinadailyhk.com

(China Daily European Weekly 09/15/2017 page27)

Today's Top News

- China to apply lower import tariff rates to unleash market potential

- China proves to be active and reliable mediator

- Three-party talks help to restore peace

- Huangyan coral reefs healthy, says report

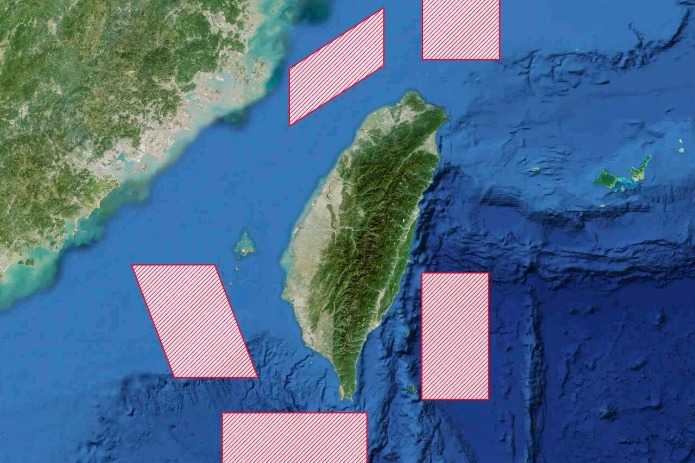

- PLA conducts major drill near Taiwan

- Washington should realize its interference in Taiwan question is a recipe it won't want to eat: China Daily editorial