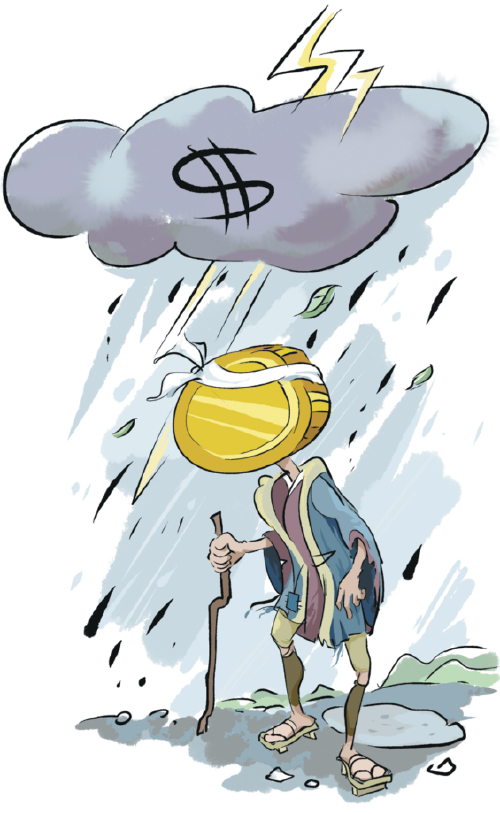

Under mounting pressure

Weakness of Japanese yen will persist as US dollar continues to gain strength, demonstrating the dilemma of non-dollar currencies

The Japanese yen has weakened markedly against the US dollar this year, especially since March. The root cause of this is Japan's relatively weak economic recovery from the pandemic, which has resulted in Japanese policymakers' reluctance to tighten Japan's monetary policy. The yen is under enormous pressure amid the widening divergence between Japan's monetary policy and that of the rest of the world, particularly that of the United States.

The Bank of Japan, the country's central bank, has been sticking to its super-loose policy stance to prop up the country's economic growth amid the sluggish recovery. The BOJ has made capping 10-year government debt yields at 0.25 percent a policy objective, as it thinks low interest rates will help support the fragile economic recovery. Meanwhile, the US rolled out a slew of economic stimulus measures on the heels of the COVID-19 outbreak that not only boosted the US economy but also resulted in surging asset prices and soaring inflation. Therefore, since the start of 2022, the US Federal Reserve has been tightening its monetary policy, constantly driving up 10-year US Treasury yield. This, along with the rising yields on other major government bonds worldwide, has put Japan's 10-year government debt yields under great upward pressure. However, in order to maintain its ultra-loose policy to bolster the economy, the BOJ is resolutely "defending "its 10-year yield ceiling of 0.25 percent, resulting in a widening interest rate spread between the US and Japanese 10-year government bonds.

Inevitably, global investors are selling off the yen and buying the dollar.

As the US dollar gains strength, most other currencies are being put in such a bind, which thoroughly displays the US dollar's hegemony. Even if the Japanese economy had recovered well from the pandemic and Japan had increased interest rates to a certain extent, the Japanese currency would still be unable to escape the fate of depreciation. For instance, even though the central banks of the eurozone, the United Kingdom and the Republic of Korea, among others, hiked their interest rates following the US steps, their currencies have been constantly depreciating against the US dollar, fully demonstrating the dilemma of non-dollar currencies. Against the backdrop of a stronger dollar and dollar dominance, the world's other currencies are bound to depreciate.

The depreciation of the yen has further widened Japan's trade deficit, which hit 853.8 billion yen ($5.73 billion) in April and further expanded to 2.8 trillion yen in August. Japan, with a shortage of raw materials, needs to import large amounts of upstream resource products including oil, gas and metals. The depreciation of the yen has resulted in a surge in yen-based import prices. With regard to exports from Japan, the bargaining power of Japanese firms has declined, making it difficult for them to hike the price of their exported products to make up for the price increase of imported products. For Japanese enterprises, in face of sustained yen depreciation, the price of imported products has been increasing at a much faster pace than that of exported products, putting them under enormous production and operation pressure. Furthermore, in order to cap 10-year government debt yields at 0.25 percent, the BOJ has been suppressing interest rates in Japan by buying heavily Japanese 10-year government bonds when the rate rises above a certain level. This has on the one hand reduced the amount of government bonds available in the market, and on the other hand lowered investors' trading enthusiasm as price fluctuations are suppressed, resulting in a cold or even frozen market. This is not conducive to maintaining normal operations in Japan's financial market. Worse still, large-scale purchases by the BOJ have caused concerns in the market over a possible collapse in the yield of Japan's 10-year government bond, should the central bank fail to stabilize the yield.

The rapid depreciation of the yen has caused concerns among Japan's central authorities. Japan's Ministry of Finance intervened in the forex market on Sept 22, the first intervention by the ministry in 24 years. However, several trading days later, the yen lost all the ground gained by the intervention.

However, the yen weakness and yen-based debts are yet to engender a crisis for Japan. To start with, the Japanese government has sufficient foreign exchange reserves, totaling $1.24 trillion as of the end of September. Japan's Ministry of Finance used 2.8 trillion yen for a market intervention in September, the equivalent of around $20 billion in foreign reserves. From a long-term perspective, such intervention has very limited effects, but the amount only accounts for a small share of Japan's total foreign reserves, indicating that the Japanese government still has sufficient tools and room to deal with future uncertainty. Second, in theory, the BOJ could defend its 10-year yield ceiling of 0.25 percent with unlimited purchases of 10-year government bonds. As the liquidity of the 10-year government bond decreases, the BOJ will face less and less pressure. It is possible that the BOJ could maintain its control over 10-year government bond yields until there is a fundamental or marginal altering in the US monetary policy that could trigger a downtrend in US 10-year Treasury yields.

Currently, Japan is "lying flat", with a hands-off approach to the yen weakness. But since the yen's exchange rate fluctuations and yen-based debts mainly depend on the external environment, especially the US Federal Reserve's monetary policy, there will continue to be mounting depreciation pressure on the yen.

The author is an assistant research fellow of the Institute of World Economics and Politics at the Chinese Academy of Social Sciences. The author contributed this article to China Watch, a think tank powered by China Daily. The views do not necessarily reflect those of China Daily.

Contact the editor at editor@chinawatch.cn.