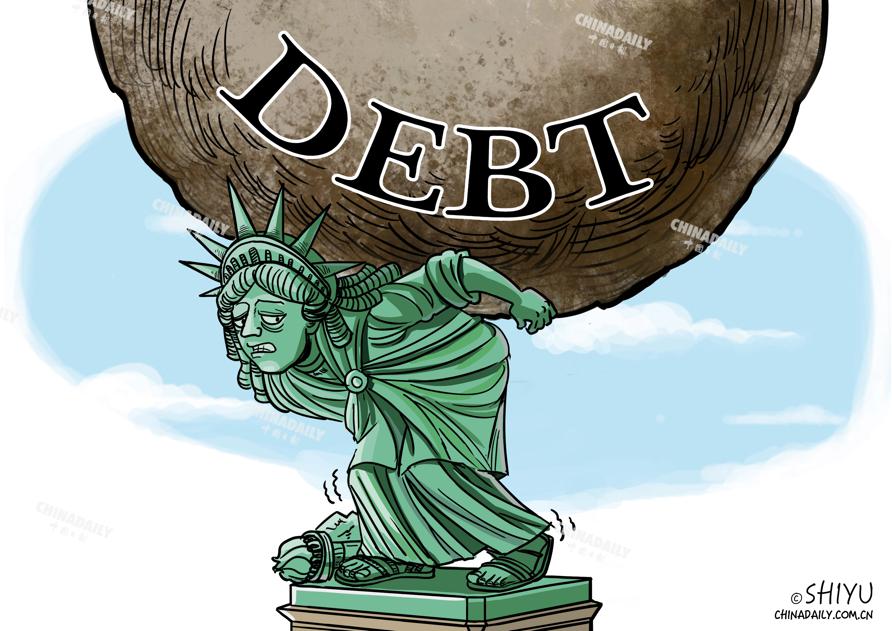

Alarming debt expansion rate calls for attention of countries

As the scale of US debt continues to expand under high interest rates, it is becoming increasingly difficult for the United States to maintain financial stability.

The Treasury International Capital data recently released by the US Department of the Treasury shows that the total amount of US bonds held by overseas investors decreased by $39 billion to $7.56 trillion in October, declining for the second consecutive month.

Although the data reflects the market two months ago, some analysts believe the oversupply of the US Treasury market has not changed. The International Monetary Fund also warned in October of the rising risk of corporate defaults as interest rates in the United States remain high.

The lack of economic growth momentum, high inflation, and high government deficit ratio have made it difficult for the US to stop debt issuance, contributing to its ever-expanding national debts. At the same time, after 11 interest rate hikes by the Federal Reserve, the US federal interest rate has increased to the 5.25 percent to 5.5 percent level, making it less lucrative for banks, pension agencies and other institutional investors to hold long-term US bonds.

Currently, the US' budget deficit for fiscal 2023 is $1.70 trillion, up $320 billion, or 23 percent year-on-year. The total US debt is rapidly approaching $34 trillion. Some analysts point out the US is getting deeper and deeper into a vicious circle of "fiscal deficit, bonds issuance, interest payments, and larger fiscal deficit".

The US dollar still occupies a dominant place in global trade settlement, the foreign exchange reserves of central banks, global debt valuation, and global capital flows, but the abuse of the dollar status by the US government and its serious overuse of the dollar credit have sowed the seeds of mistrust among other countries, enhancing their willingness to pursue a diversified international monetary system.

While some foreign investors, mainly US allies such as Japan, the United Kingdom, Canada and France, have increased holdings of US Treasuries this year, more countries continue to reduce their holdings of US Treasuries.

As early as January, US Treasury Secretary Janet Yellen warned that any failure of the federal government to pay its debts will trigger an economic recession in the US. At the time, the total US debt was approaching $31.4 trillion, but in less than a year it stands at $33.94 trillion and is approaching $34 trillion. This rate of debt expansion is putting the US and the rest of the world in huge danger.

ECONOMIC DAILY