|

BIZCHINA> Top Biz News

|

|

Related

Businesses positive about corporate tax law

By Bi Xiaoning (China Daily)

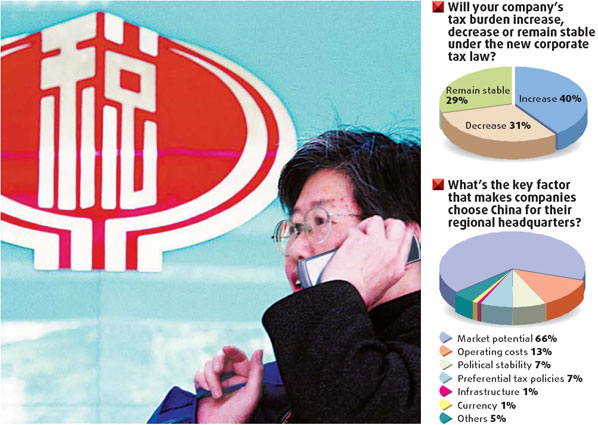

Updated: 2008-04-11 10:21  A survey of how the business community views China's tax system has revealed overwhelming support for the government's new corporate income tax law, with 85 percent of the respondents saying it has had a positive impact on the economy. CPA Australia, the world's sixth largest accounting body, surveyed 162 financial, accounting and business professionals across China last month, at which point the new corporate tax law had been in effect for three months. "We are delighted with the survey findings," Henry Chan, president of CPA Australia Beijing Committee and partner with Ernst and Young China, said. "There is clear support for the corporate income tax law, and the vast majority are confident it will further strengthen China's prosperous economy." The corporate tax rate was lowered to 25 percent from 33 percent in January. The rate for small businesses is only 20 percent, while hi-tech companies pay just 15 percent. Thirty-one percent of the respondents said their organizations' tax burden would decrease, and 38 percent said their organizations would invest more in China as a result of the new law. Forty percent said their companies would be paying more tax. Companies operating in the country's special economic and technology development zones pay the 15 percent tax rate, but that will increase as the new law is phased in over the next five years. These companies will pay 18 percent by the end of this year, 20 percent next year, 22 percent in 2010, 24 percent in 2011 and 25 percent from 2012. Coastal areas with a tax rate of 24 percent had to raise their rate to 25 percent this year, while the comparatively economically depressed western parts of the country will enjoy the privileged tax rate until 2010. Noting that 43 percent of the survey's respondents said they did not know if their businesses would benefit from the transitional tax policy, Chan said certain aspects of the corporate income tax law would have to be clarified. Environment focus The law also reflects the government's focus on protecting the environment by offering a three-year tax exemption followed by a three-year half deduction for energy- and water-saving projects. Government bodies are expected to make the tax rate more preferential for those sectors. Sixty-one percent of the respondents said they would like to see more tax incentives offered to businesses that embrace environmentally sound practices and technologies. The law deducts 150 percent of enterprises' investments in environment-related research and development before collecting corporate income taxes. However, 62 percent of the respondents said they would like to see a higher deduction rate, with 69 percent saying that a 200 percent deduction would be reasonable. "The State Administration of Taxation and the Ministry of Finance are drawing up preferential tax policies to address these issues in a practical manner. Specific laws can be expected in the coming two months," Chan said. (For more biz stories, please visit Industries)

|

主站蜘蛛池模板: 萨迦县| 黑水县| 安福县| 大关县| 鲁山县| 新密市| 蓬安县| 辽阳市| 云霄县| 交口县| 鹤岗市| 会宁县| 天门市| 繁昌县| 浦县| 额尔古纳市| 龙江县| 泽库县| 漳浦县| 宁强县| 府谷县| 通辽市| 鄂托克前旗| 镇平县| 永德县| 清丰县| 休宁县| 黄浦区| 福海县| 肇庆市| 商河县| 南通市| 咸阳市| 夹江县| 潞城市| 社旗县| 时尚| 济阳县| 昌都县| 霍州市| 邻水| 玛纳斯县| 凤城市| 马鞍山市| 文成县| 衡南县| 张家川| 繁昌县| 灵璧县| 安溪县| 三门峡市| 乐陵市| 南部县| 满城县| 渭源县| 莒南县| 延长县| 玉林市| 斗六市| 瑞金市| 平武县| 屏东县| 竹溪县| 冕宁县| 桓仁| 隆化县| 弋阳县| 缙云县| 普陀区| 彰武县| 松阳县| 呼和浩特市| 星子县| 读书| 瑞丽市| 永寿县| 广元市| 芦山县| 建昌县| 灵璧县| 常宁市| 婺源县|