Top Biz News

Equities decline, led by real estate firms

(China Daily/Agencies)

Updated: 2009-12-19 08:27

|

Large Medium Small |

|

|

|

An investor at a brokerage in Foshan, Guangdong province. Mainland firms have raised $25 billion through IPOs this year. [CFP] |

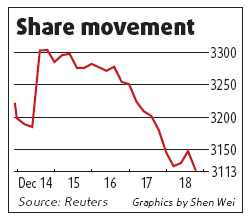

Mainland stocks fell for a fourth day on Friday, the longest losing streak since August, on concern the government will step up measures to curb property speculation and new share sales will divert funds from existing equities.

Poly Real Estate Group Co slumped for a ninth day after the government increased down payments on land purchases. China Life Insurance Co, the nation's biggest insurer, dropped 2.6 percent to a two-month low.

Initial public offerings on the ChiNext board have drawn almost 900 billion yuan in subscriptions, the China Securities Journal said yesterday.

"It looks like the government is using new share sales as a way to avoid an asset bubble on the stock market," said Zhang Xiuqi, a Shanghai-based strategist at China International Fund Management Co, which oversees about $10.2 billion. "The crackdown on the property industry is tougher than was previously expected."

The Shanghai Composite Index fell 65.19, or 2.1 percent, to 3,113.89 at the close, the lowest since Nov 27. It dropped 4.1 percent this week, a second weekly loss. The CSI 300 Index declined 2.5 percent to 3,391.74.

The Shanghai gauge has jumped 71 percent this year as government spending and a credit boom helped the nation's economic growth recover from its steepest slump in more than a decade.

Developers slump

Poly Real Estate, China's second-largest developer by market value, fell 7.5 percent to 21.88 yuan, capping a nine-day, 16 percent slump. Gemdale Corp, the fourth largest, lost 7.8 percent to 13.20 yuan. Shanghai Shimao Co, a property developer controlled by billionaire Xu Rongmao, retreated 4.8 percent to 15.77 yuan.

China's government set the down payment requirement for land purchases to at least 50 percent of the total price, the Ministry of Finance said. The new down payment level is an increase from earlier levels, said Zhou Hu, a real estate analyst at Bohai Securities Co in Beijing.

An index tracking 33 property stocks traded on the Shanghai Composite tumbled 5.4 percent yesterday, its biggest loss since Aug 31.

Property stocks have slumped this week after the government said it would target "excessive" growth in property prices in some cities. That follows the cabinet's statement last week that it will re-impose a sales tax on homes sold within five years, after cutting the period to two years in January.

The country's property and stock markets are a "bubble" that will burst when inflation accelerates in 2011, former Morgan Stanley chief Asian economist Andy Xie said.

China Life lost 2.6 percent to 29.47 yuan. China Merchants Securities Co retreated 3 percent to 28.73 yuan. Shanghai Pudong Development Bank Co, the Chinese partner of Citigroup Inc, dropped 3.1 percent to 20.73 yuan.

Fitch warning

In addition to IPOs on the ChiNext startup board in Shenzhen, China CNR Corp, which supplies rail cars used in Beijing's subway, said it plans to raise as much as 13.9 billion yuan in a Shanghai IPO, while China National Chemical Engineering Co said it intends to raise 2.92 billion yuan.

The sales cap a year in which companies have raised $25 billion in first-time offerings in the mainland, making it Asia's biggest IPO market, according to data compiled by Bloomberg.

| ||||

The growing amount of unreported loan transactions, including re-packaging loans into wealth management products to sell to investors and the outright sale of loans to other financial institutions, represent a "growing pool of hidden credit risk" and may lead to downward revisions for some China banks in 2010 and 2011, Fitch said in its latest report.

Jiangxi Copper, the country's biggest producer of the metal, tumbled 6.2 percent to 37.96 yuan, as commodity prices declined. Zijin Mining Group Co, China's largest gold producer, retreated 4.3 percent to 9.63 yuan. Aluminum Corp of China Ltd, the nation's biggest maker of the lightweight metal, slumped 8.4 percent to 13.89 yuan.

The London Metals Index, a measure of six metals including copper and aluminum dropped 2.2 percent on Thursday, the most this month. Gold slid 2.5 percent in New York, the biggest decline since Dec 4.