China trims US debt holdings again

Updated: 2011-12-17 09:55

By Li Xiang (China Daily)

|

|||||||||||

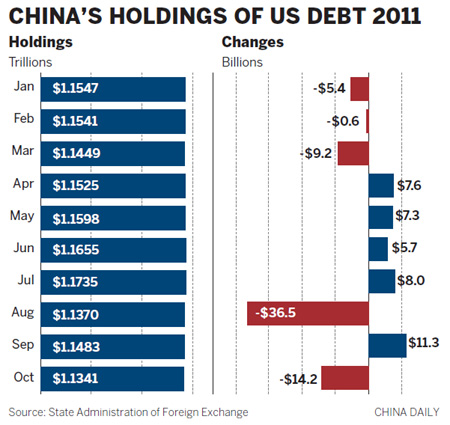

BEIJING - China trimmed its holdings of US Treasury debt by $14.2 billion in October, driving its holdings to the lowest level this year.

The move came against a backdrop of recent yuan weakness and on the declining positions of Chinese banks for foreign exchange purchases, an indicator of capital outflows.

Analysts said that the move to cut the US debt holdings indicated an attempt by the People's Bank of China (PBOC) to increase its cash holdings of dollars in order to shore up the value of the yuan.

The yuan has been faced with increasing downward pressure as investors sold the currency and sought a safe haven in the dollar amid a grim outlook for the global economy.

"The low level of China's holding of US debt indicates the huge pressure of capital outflow that the country has been faced with," said Lu Zhengwei, chief economist with Industrial Bank Co Ltd.

"The central bank is increasing its holdings of dollars in cash, preparing to sell them in the market if necessary to offset the impact of liquidity outflows," he said.

The yuan traded higher on Friday after touching the low end of its permitted daily trading range for 12 consecutive sessions, the longest run of trading days in which the yuan had weakened.

China held a total of $1.13 trillion of US Treasury debt as of October 2011, roughly accounting for 24 percent of total foreign holdings of US debt, according to the US Treasury Department. Despite the latest cut, China remains the largest foreign holder of US treasuries.

Analysts said that China should continue to accelerate the diversification of its $3.2 trillion foreign-exchange reserves, amid growing global financial uncertainty. Currently, about one-third of China's foreign-exchange reserves is invested in US Treasury bonds.

It was reported that the PBOC plans to create a fund worth $300 billion to invest the country's foreign-exchange reserves in the US and European markets. The fund will reportedly seek to invest in real assets and company shares, rather than government securities.

Gao Xiqing, vice-chairman of China Investment Corp, the country's sovereign wealth fund, said recently that the fund is actively looking for investment opportunities in infrastructure projects in countries including Britain, the US, and Brazil.

Related Stories

China cuts holdings of US debt 2011-10-20 07:46

Eurozone woes drive China back into US bonds 2011-11-18 08:03

Insurmountable debt 2011-11-10 07:45

China's $3.2 trillion headache 2011-08-24 17:41

- Beijing to keep limitations on house purchases

- China to unveil new energy consumption strategy

- Christmas chill hits manufacturing hub

- Capital market for returning yuan

- China trims US debt holdings again

- China sets goal for unemployment

- China cuts import tariffs for balanced trade

- Chinese stocks rally over 2% Friday