Weak markets pose fund investment risk

Updated: 2011-12-26 13:55

By Li Xiang (China Daily)

|

|||||||||||

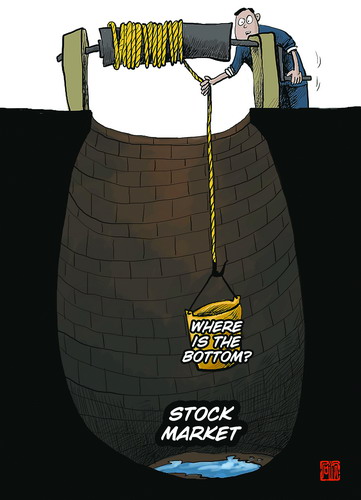

BEIJING - China's weak and immature equities market could pose serious difficulties for investment of the country's pension funds, but allowing the funds to enter the capital market could help improve short-term market liquidity, analysts said.

China's securities regulator is pushing for a plan that will allow the country's nearly 2-trillion-yuan ($317 billion) pension and its 2-trillion-yuan housing funds to be invested in the stock market.

"Given the weak stock market and limited investment products, it is a daunting challenge for such funds in China to keep pace with inflation and domestic GDP growth, which are the two basic goals of pension investment in developed markets," said Chen Zhiwu, economics professor at Yale University.

The benchmark Shanghai Composite Index has slumped more than 20 percent this year and it is trading at a record low estimated price-to-earnings ratio of 10.5 times.

But Chen said that long-term investment of the pension fund in the stock market could have a stabilizing effect and help lift the market in the short term.

"The valuation of the A-share market has hit a record low and it is a reasonable time to invest some of the pension fund in the market," said Chen, who is also chief advisor of the US fund of hedge funds Permal Group. "I expect the market to rebound from the second half of next year."

It was reported that China is considering setting up an agency, similar to the National Council for the Social Security Fund, which would invest a portion of the local pension funds in the country's capital markets on behalf of local governments.

Market watchers said that the plan was a clear signal from the central government of support for the weak stock market.

"The pension funds, corporate annuities and other forms of social insurance funds will need professional services from securities companies to preserve and increase their assets," Guo Shuqing, chairman of the China Securities Regulatory Commission, said at a recent economic forum.

"There are about 2 trillion yuan of pension funds scattered across the nation. The national public housing fund has outstanding capital of 2.1 trillion yuan. If we can find a way to put them in the capital market, it will benefit everyone," Guo said.

By the end of 2010, the value of China's five social insurance funds, among them pensions, industrial-injury and maternity funds, had reached 2.39 trillion yuan, according to the Ministry of Human Resources and Social Security. But only 36.9 billion yuan was invested in securities, while 36.6 billion yuan was under the management of trustees.

The lack of investment products and professional managers in the market has resulted in large amounts of pension funds sitting in low-yielding instruments such as bank deposits and government bonds.

However, some analysts are concerned that investing these massive pension funds in the country's immature stock market will jeopardize pensioners' interests.

Although the newly appointed chairman of the China Securities Regulatory Commission has announced a series of high-profile measures to promote the healthy development of the stock market, investor confidence has been shattered in recent years by allegations of rampant insider trading and market manipulation.

"Putting the pension fund in a market plagued by scandals is like putting a sheep in a wolf's mouth," wrote Ye Tan, a well-known financial commentator, in her column.

Chen said the regulator needs to enrich market investment products and tools to broaden investment channels for pension funds. In the meantime, the regulator should improve the delisting process and create a mechanism to allow investors to short the market.

Related Stories

Stocks slide to 31-month low 2011-10-21 08:06

Stocks rally on talk of gov't support 2011-10-13 07:49

China's stocks rise most in four weeks-Sept 21 2011-09-21 15:40

China stocks slide more than 1.7% Sept 19 2011-09-19 15:38

China stocks end higher Sept 16 amid optimism 2011-09-16 15:42

Policy concerns drag equities 2011-09-16 07:44

- Weak markets pose fund investment risk

- New niche market: Affordable smartphones

- China launches super-speed test train

- PBOC urges less reliance on foreign credit ratings

- Group-buying firms look to Taobao

- Bank reserves 'may be cut again next year'

- Surplus revenue is a taxing problem

- Provincial borrowers defer loan payments