Currency rallies after quantitative easing in US, bond buying by ECB

The exchange rate of the Chinese currency hit a record high on Thursday after the country reported that September saw the largest jump in capital inflows since February. But some analysts doubted whether the recent gains could be sustained.

|

|

|

Confidence in the yuan has strengthened, as 77 percent of Chinese companies surveyed by HSBC Holdings Plc expect one-third of all Chinese trade to be conducted in yuan by 2015. [Photo/China Daily]?? |

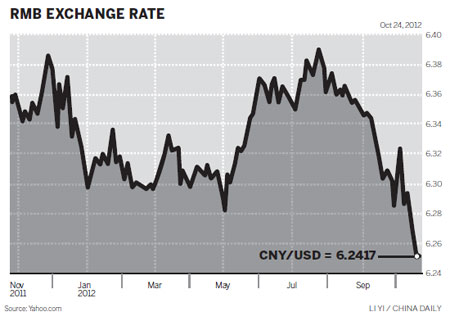

The currency hit 6.2417 yuan per dollar, the strongest level in 19 years, and touched the permitted 1 percent upper limit of the officially set reference rate.

The renminbi has been going up and attracting capital inflows since the introduction of the US Federal Reserve's third-round quantitative easing program and the European Central Bank's bond-buying plan.

Yuan holdings among banks for purchasing foreign exchange, a key measure of capital flows, rose 130.7 billion to 25.8 trillion yuan in September, and followed falls in July and August.

This was supported by a brighter outlook for the Chinese economy as the trade surplus rebounded and fixed-asset investment accelerated in September, said Guo Tianyong, a professor at the Central University of Finance and Economics.

As the growth of the world's second-largest economy fell to a three-year low and softened for the seventh consecutive quarter, such holdings declined by 17.4 billion yuan in August, after a drop of 3.8 billion yuan in July.

Lian Ping, chief economist at Bank of Communications, said as major economies stabilize and capital continues to flow into emerging countries, yuan holdings for purchasing foreign exchange would continue to grow in the next few months, further dampening the possibility of the central bank lowering interest rates.

"And there is no need to lower the reserve requirement ratio for commercial lenders given the capital inflows. Maybe in 2013 the ratio would be cut once or twice."

But some experts expressed concern, noting that the rebound in China's economy still faces challenges amid the uncertain global economic outlook.

"It's still hard to tell the capital flow direction for the next few months as the international financial market tumbles. But the growth in yuan holdings in 2012 will surely fall compared with past years, mainly due to drops in the trade surplus," said Zhao Xijun, deputy dean of the School of Finance at Renmin University of China.

Apart from the Chinese mainland, other economies also witnessed increasing short-term speculative capital inflows, or "hot money", following the Fed's QE3.

The Hong Kong Monetary Authority injected more than HK$14 billion into the market to stabilize its currency.

Despite a tendency for the People's Bank of China to set a stronger yuan reference rate ahead of important international events and meetings, on closer inspection, the recent yuan strength has mainly been driven by market forces such as capital flows as opposed to the policy of the central bank, said Khoon Goh, a senior foreign exchange strategist at the Australia and New Zealand Banking Group.

Analysts have said that the International Monetary Fund and World Bank annual meetings and the US presidential debates in October were the major reasons behind a stronger yuan.

"The yuan non-deliverable forwards curve continues to price in a depreciating profile. However, the return of capital inflows into China, together with further signs that economic activity is starting to pick up, should see the market reassessing yuan expectations," Goh said.

The renminbi has strengthened more than 2.4 percent since it touched its weakest point of the year at 6.3967 in late July. It has appreciated 0.8 percent since the beginning of the year.

Stephen Green, chief China economist at Standard Chartered Bank, said the Chinese currency would climb to 6.19 per dollar by the end of 2013.

Nick Verdi, a foreign exchange analyst at Barclays, said: "We do not think this pace of yuan appreciation will be sustained near term, with the risk tilted toward a move higher in the fix of the dollar against the yuan, given the negative impact on Chinese export competitiveness."

Confidence in the currency has strengthened, as 77 percent of Chinese companies surveyed by HSBC Holdings Plc expect one-third of all Chinese trade to be conducted in yuan by 2015, and 30 percent plan to use the currency for investment-related purposes in the next 12 months.

Chinese individuals and institutions sold more foreign currency than they bought through banks in September, making net sales of $6.3 billion, compared with net purchases of $6.3 billion in August, according to the State Administration of Foreign Exchange.

"The increasing willingness to sell foreign currency and hold yuan was mainly due to the recent appreciation of the yuan," said Zhou Jingtong, an economist at Bank of China Ltd.

"But it's uncertain whether this appreciation will continue. The currency will probably fluctuate in both directions in the near future. And neither appreciation nor depreciation expectations will predominate," he said.

wangxiaotian@chinadaily.com.cn