|

|

Zhang Chengliang / China Daily |

Government turns to market forces in battle to bring about corporate change for the better

Chinese companies have borrowed enormous amounts in recent years, with the total outstanding corporate debt reaching an estimated $1.3 trillion (946 billion euros) this year, about 1.5 times China's GDP. Most of this borrowing is from banks, but the growing proportion of corporate borrowing through bond issues has driven China's bond market, now around $4.8 trillion, to become the world's fourth-largest after the United States, Japan and the European Union. Corporate bonds have been the fastest growing part of China's bond market boom, with total amounts borrowed by Chinese companies in that market increasing 10 fold in seven years.

This surge in Chinese corporate borrowing has been made possible by two things: the underlying profitability of much of China's business sector, which has created stronger creditworthiness, and the strong credit growth unleashed by China's monetary authority, the People's Bank of China, in 2009 to offset the negative impact of the US credit crisis.

|

|

|

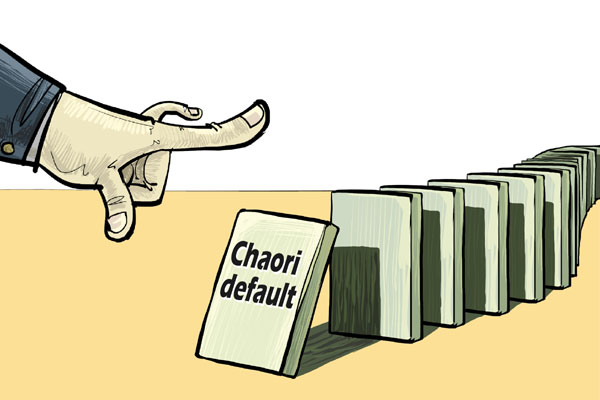

Early last month the solar cell maker Shanghai Chaori Solar Energy Science and Technology Co Ltd announced that it could not pay interest of 89.8 million yuan ($14.5 million, 10.5 million euros) that was due to holders of the 1-billion-yuan bond that Shanghai Chaori had issued in the Shanghai bond market in 2012. The company cited a credit squeeze and its inability to raise funds as the reasons for the default. Last year another Chinese solar panel producer, Suntech, defaulted on a foreign bond. But Chaori's default was the first in China's corporate bond market.

With it, the guarantee implicit in the Chinese bond market of government support for borrowers that could not meet their liabilities suddenly disappeared. The impact on China's booming bond market was immediate. Chinese bond investors, mostly large financial institutions, demanded higher annual returns to compensate them for the increased risk of default. Corporate bonds below the most secure rated levels of AAA suddenly became more expensive. Annual yields on AA- debt rose the day after the announcement by five basis points to 7.82 percent. Equally significant, in the days following Chaori's default, a number of Chinese companies announced they would delay or cancel planned bond issues: Taizhou Kouan Shipbuilding (330 million yuan), Xining Special Steel (470 million yuan) and Suning Chuanzhong (1 billion yuan).

This is not the first time in China, since the beginning of the reform period, that a company has been allowed to default. As long ago as 1988 Shenyang Explosion-Proof Equipment Factory, an unprofitable State-owned company, was declared bankrupt by the Shenyang government, which had introduced the first bankruptcy law in China in 1986. Several years later as the economy boomed, Guangdong Investment Trust and Investment Co raised large sums from foreign lenders who assumed that GITIC was implicitly supported by the central government. The foreign lenders were wrong.