Scott McFarlane, a property agent in Houston, said Chinese investors are getting increasingly realty-savvy and have a clear idea of the kind of property they need.

"In the past, (Chinese) buyers would decide to buy a property just by looking at PowerPoint. Now, they would like to do on-site research, talk to lawyers, property inspectors and agents, and visit the properties time after time before they sign the deal," said McFarlane.

Location of a property is key: Proximity to a prestigious school or university is a big factor. For instance, Zhou Yilan said she settled for the LA house because it is just a 15-minute drive from a local high school that her daughter will enroll into next year.

She also likes the neighborhood of lush woods, and tranquil, peaceful surroundings, a contrast to her apartment's location in her hometown. In Chinese cities, people prefer downtown apartments. In the US, people prefer silent neighborhood, she said.

Other factors include price and size.

Typically, Chinese buyers prefer spacious properties, with at least three bedrooms, because friends and families often visit.

Since only a few buyers are able to obtain mortgage from local banks, others must make full payment in cash.

So, a lot of Chinese buyers prefer US properties priced between $500,000 and $2 million, not like in China where they tend to buy the most spacious and expensive ones they can afford, betting on value growth.

Analysts said Chinese buyers increasingly survey the investment destinations and study each property.

Henry Chin, CBRE's head of research, Asia-Pacific, said Chinese investors now realize the property market is quite different from the stock market, and that even two properties in the same neighborhood may have different potential for appreciation in value.

"While the stock market's performance of one country may immediately affect that of another, the same can't be said of the property markets. So, it requires a lot of research for investors to decide," said Chin. CBRE's research showed most Chinese buyers of US properties are not driven by the potential for value appreciation or rental returns. Instead, they buy properties for own use or for their US university-bound children.

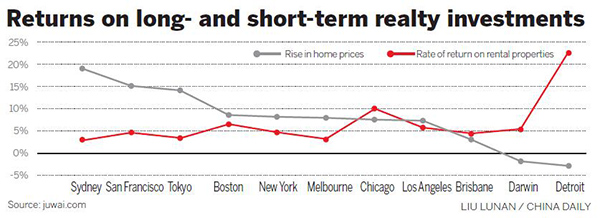

"For this reason, traditional popular destinations, including Los Angeles, San Francisco, New York and Washington, are still the hottest destinations. For people seeking rich yields from property investments, sub-premier locations can be a good option," said Chin.

Most Chinese investors prefer new properties to used homes even though used homes in the US do not need much refurbishment. The key criterion is, homes must be decorated, and in a ready-to-move-in condition. Another striking feature is Chinese buyers tend to buy properties that are not distant from their families' or friends' homes. Sometimes, a group of buyers visits newly developed properties together and buys adjacent units, to become neighbors in the future.