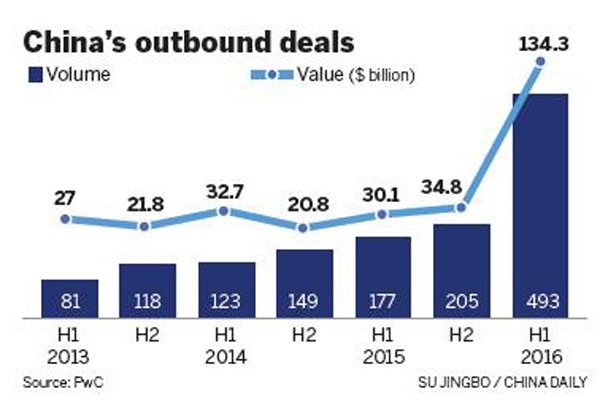

Chinese outbound mergers and acquisitions hit a record in the first half of 2016, benefiting from smooth financing in the A-share market and the rise of financial investors, according to a report from PricewaterhouseCoopers on Wednesday.

There were 493 outbound merger and acquisition deals made in the first six months, an increase of 178.5 percent year-on-year. Their value totaled $134.3 billion, an increase of 346.2 percent year-on-year, more than that of the previous two full years combined, PwC data showed.

Even after deducting China National Chemical Corporation's $43 billion bid for Swiss seeds and pesticides group Syngenta AG, the biggest ever outbound M&A deal by a Chinese buyer, the value of China's outbound M&A activity grew by 203.3 percent year-on-year.

"The dramatic growth in outbound M&A deals is supported by the smooth financing in the stock market and the rise of alternative financial investors, such as the investment arms of large corporations and State-owned enterprises and insurers," said George Lu, PwC China transaction services partner.

Lu added that Chinese companies sought advanced technology, know-how and brands. They looked favorably on low valuations of some overseas assets and allocated funds globally to prevent risks.

"There was a sharp increase in outbound deal activity by both State-owned and private enterprises in the first half," said Leon Qian, PwC China transaction services northern China leader.

"But while private enterprises have dominated in terms of outbound M&A deals for some time, they have overtaken SOEs in terms of deal value as well, " said Qian, adding that two-thirds of the 20 largest outbound M&A deals in the first half were made by private enterprises.

Technology, consumer, media and entertainment sectors became the most popular in the first half among Chinese buyers since they can provide services to the emerging middle class and growing consumer culture in China, the report said.

Private equity investors and other alternative financial buyers with a huge supply of investable capital played an important role in outbound mergers and acquisitions.

Developed economies continued to attract Chinese buyers because they have technologies, platforms and brands. Plus, they have large and mature consumer markets.

Because of the strong performance of outbound mergers and acquisitions, China's total merger and acquisition activity also hit a record in the first six months-growing to $412.5 billion. This is up 21.2 percent by deal volume and 26.7 percent by deal value year-on-year.

"The outbound M&As will continue to be strong in the second half and Chinese buyers can be aggressive bidders in auction situations," said Qian.

Qian said Chinese outbound M&A activities by financial investors will continue to grow because major deals require huge funds available in China. "2016 is already a record year for China's outbound M&As, and the full-year deal value is expected to be more than 3 times the previous record set in 2015," said Qian.