European countries' fiscal woes and the poor outlook of US economic recovery have sent investors scurrying to buy US Treasuries.

This risk-aversion strategy of investors has forced the US Treasuries' yield to fall by a large margin. The benchmark 10-year Treasury note's yield dropped to 2.924 percent on June 30, the weakest since April 2009, while the 30-year Treasury bond's yield touched 3.892 percent, the lowest since October 2009.

Increasing worries over a potential double-dip global recession have, however, rallied the US Treasuries market and made them the best-performing fixed-income assets.

A US Treasury security is government debt issued by its Department of Treasury. Treasury securities (or just Treasuries) are the debt-financing instruments of the US government and are available in four forms: Treasury bills (which mature in one year or less), Treasury notes (mature in one to 10 years), Treasury bonds (mature in 20 to 30 years) and Treasury inflation-protected securities (or TIPS that mature in five to 30 years).

The future development of the global financial and debt crises may tell us why the US Treasuries market could perform so well. But the sovereign debt crises have disturbed the internal stability of the global financial market and are even upsetting the market's role in setting the price of risk assets and resources allocation. The long process of fiscal restructuring in various countries and could turn the distortion of sovereign debt crises and disturbing of risk assets pricing into a practice.

Though the massive 750-billion-euro rescue package put together by the European Union (EU) and the relaxation on assets mortgage rules by the European Central Bank have lowered the short-term debt-paying risks of Greece and other debt-ridden EU countries, they haven't allayed people's fear over further fiscal deterioration and financial risks in the eurozone.

The Greek government's two-year bonds yield has surged from 1.348 percent six months ago to 7 percent and the interest burden of government bonds has increased five times, worsening the country's liability financing environment. The mounting financial risks and increasing need to avert those risks have forced funds to flow out of the global capital markets and caused sharp decline in asset prices.

But the US dollar assets, including US Treasuries, securities and other institutional bonds, are being hotly pursued, causing the yields on 10-year notes and 30-year bonds to hit new lows. That the US Treasuries have become the so-called "safe assets" reflects the trend of global "deleveraging", or repaying (a company's or government's) debts to avoid the risk of default and attract more investors.

The first deleveraging has been at the government level. While tackling the crisis, most developed economies adopted expansionary fiscal and monetary policies, which significantly increased their debts and filled the global financial system with cheap liquidity.

On top of the PC world

On top of the PC world

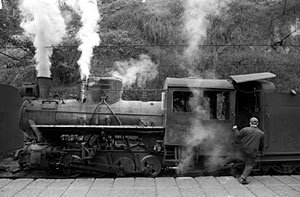

China's only existing steam train

China's only existing steam train

Chongqing auto expo lures with discounts and cash

Chongqing auto expo lures with discounts and cash

Graduate studies new pottery techniques

Graduate studies new pottery techniques

Self-service vegetable and newspaper stands in China

Self-service vegetable and newspaper stands in China

Tianjin coal port is where his heart is

Tianjin coal port is where his heart is

Swimming pigs worth triple

Swimming pigs worth triple

Private jet dealer exhibits aircraft models

Private jet dealer exhibits aircraft models