The crisis began with cheap credit and excessive debt, and ended with even cheaper credit and more extensive debt. The only difference is that in the past loans entered the real economy directly and debt risks were concentrated mainly in the private sector, but the liquidity now largely circulates within the financial system and debt risks are swiftly transferred to the public sector.

The current debt and fiscal troubles are a problem facing all wealthy countries. To push their debts below 60 percent by 2030, they have to raise the average structural primary balance by 9 percentage points of their GDP between 2010 and 2020.

The second deleveraging has been in the financial system. In the process of financial globalization, an important trend of financial capitalism development is the "derivativization" of financial instruments, that is, leveraging.

The US takes advantage of its advanced financial system to enable huge funds to circulate in the equity, foreign exchange, bond and futures markets, as well as all kinds of financial derivatives markets, increasing the leverage.

While the financial crisis and debt troubles halted the growth of credit in many economies, the process of deleveraging has just begun. To avoid risks, financial institutions have to switch on deleveraging. So they have to reduce the proportion of risk assets in their asset portfolio and turn to Treasuries, particularly US Treasury bonds for better safety. And the US financial supervision bill will further boost the trend.

The third leveraging has been at the household level. Damaged individual balance sheets need a long time to recover, and low inflation rate and slow growth of nominal income make it more difficult for deleveraging to continue. This in turn will severely curb individual consumption in the US and economic recovery.

Till the first quarter of 2010, the US household net worth was $54.6 trillion, down $11.4 trillion from its peak in 2007. It is estimated that it would take several years for America's debt-to-income ratio to reach a sustainable level. This means US government bonds will be a popular asset across the world for a long time simply because there is no alternative.

The author is a research scholar

in economics with the State

Information Center.

(China Daily 07/09/2010 page9)

On top of the PC world

On top of the PC world

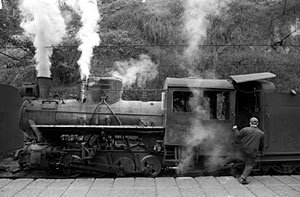

China's only existing steam train

China's only existing steam train

Chongqing auto expo lures with discounts and cash

Chongqing auto expo lures with discounts and cash

Graduate studies new pottery techniques

Graduate studies new pottery techniques

Self-service vegetable and newspaper stands in China

Self-service vegetable and newspaper stands in China

Tianjin coal port is where his heart is

Tianjin coal port is where his heart is

Swimming pigs worth triple

Swimming pigs worth triple

Private jet dealer exhibits aircraft models

Private jet dealer exhibits aircraft models