Taxing times despite new rate

Updated: 2011-08-23 09:23

By Yu Ran (China Daily)

|

|||||||||||

|

|

|

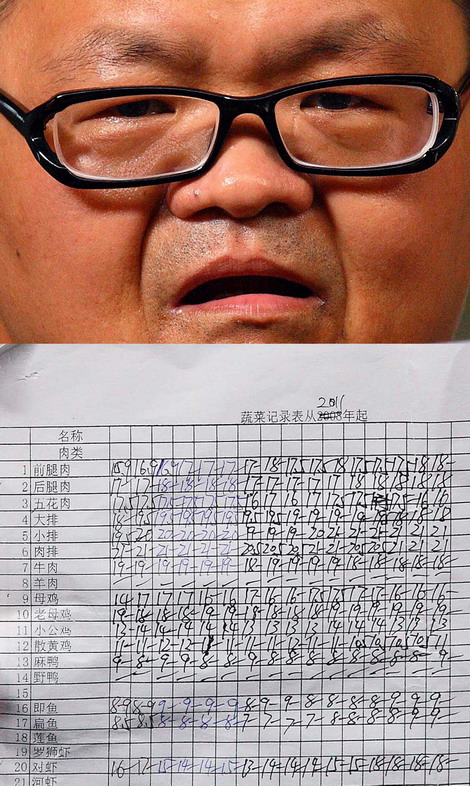

Zhao notes the prices of vegetables every day (top and above). He will benefit when changes in the personal income tax begin Sept 1. |

Some middle-class white-collar workers who earn higher incomes and own property have found a creative way to save money. "There has been an obvious increase in 'secondhand landlords'," said Ying Jie, a sales manager for a property agency in Shenzhen.

If a single person owns a three-bedroom apartment in downtown Shenzhen and puts it up for rent, Ying said, he will receive at least 8,000 yuan as monthly rent income. He can rent a one-bedroom apartment to live in outside downtown for about 3,000 yuan, which means he can earn 5,000 yuan from his own property.

"Most of these clients told me they had to take all their chances to make profits and save money in order to pay increasingly higher taxes for everything and handle severe inflation," Ying said.

Doubts, expectations

Data from the Ministry of Finance show that total national tax revenue for the first six months this year exceeded 5 trillion yuan, which was 29.6 percent higher than a year earlier. That includes the value-added tax, which is included in the price of many items, in addition to personal income tax.

Residents doubt that the coming reduction in the tax on salaries will come close to compensating for the high VAT they pay in daily life, said Ma Hongman, an economist at the Shanghai Academy of Social Sciences.

Ma also said the income threshold is too low to benefit most residents of first-tier cities, such as Beijing, Shanghai and Guangzhou. Their salaries are higher because they live in places where the living costs are high.

Liu Zi, a sales assistant at a cinema in Chengdu, Sichuan province, does not expect the higher taxation threshold to keep middle- and low-income citizens from poverty.

"When people buy goods in supermarkets and restaurants, they pay a lot in taxes without being aware of it, which is what burdens low-income families in real life." Liu said the value-added taxes on food, medicine, clothes and other daily necessities should be cut along with the income taxes.

Experts also suggested that the income levels and living standards in different cities throughout China should be considered to provide a more balanced tax policy.

"Overall," Zhang said, "the coming amendment of personal tax policies is a good sign that China is making the first move toward tax reform, which obviously will lead to a more complete and comprehensive plan to benefit citizens."