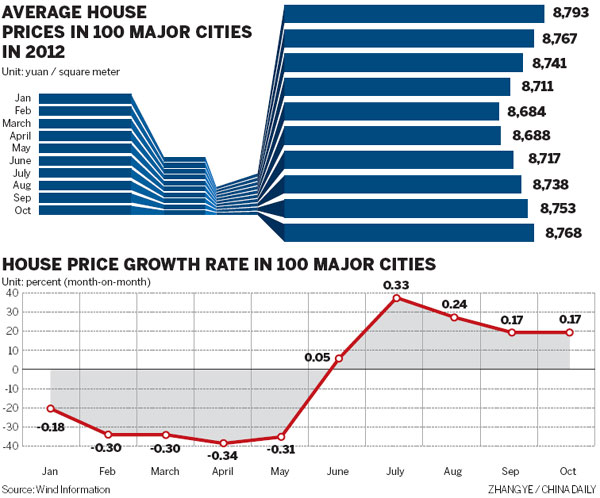

House prices in China's 100 major cities rose further in October, marking the fifth consecutive monthly increase this year, but did so at a very low growth rate, statistics from China Index Academy showed on Thursday.

The average price of new homes in the 100 cities increased 0.17 percent month-on-month to 8,768 yuan ($1,390) per square meter last month, at the same growth rate as in September.

Among the 100 cities, 56 saw prices increase on a monthly basis, compared with 60 in September. And 42 cities experienced a price drop, compared with 38 in the previous month.

Average new-house prices in 10 key cities, including Beijing and Shanghai, rose 0.33 percent on a monthly basis to 15,625 yuan per square meter. But the growth rate of pre-owned house prices shrank significantly, and six saw prices drop in October, compared with only one in September, according to the academy.

"The property market will stabilize in the remaining months of this year. Property sales and prices will be unlikely to fluctuate by a wide margin," said Carlby Xie, head of research at the real estate consultancy Colliers International (Beijing).

Jane Murray, head of research at Jones Lang LaSalle Asia-Pacific, said prices in China's residential sector are unlikely to rebound significantly in the next 12 months, due to the large supply.

"The trend in house prices in the short term, we believe, largely depends on monetary policy and whether real estate restrictions will continue or not," said Zhou Hao, an economist at ANZ Banking Group Ltd.

After a strong rebound in transactions in July and August, sales in October - a traditionally hot month for property sales - were flat.

Property sales in 54 major cities dropped 6.4 percent month-on-month in October, the third consecutive monthly drop, according to the real estate consultancy Centaline Group.

It said 212,713 apartments were sold in October, compared with 227,000 in September.

Second-tier cities, such as Suzhou, Hangzhou and Qingdao, saw the biggest drop, as demand there was not as strong as in first-tier cities.

"Most of the demand from self-use buyers has been met during the strong rebound since March," said Zhang Dawei, research head of Centaline Beijing.

But with the land market remaining hot and land prices further picking up, Zhang said property prices will also increase.

House prices have reversed declines since June, when the central bank cut interest rates to stem an economic slowdown and some local authorities eased restrictions as land-sale revenues fell.

China's property curbs have shown "preliminary effects", though the market remains "unstable", Xinhua News Agency reported on Oct 17, citing Premier Wen Jiabao's comments at his meetings with industry leaders, company executives and local government officials between Oct 12 and 15.

The government should stick to its property policies, Wen said.

To tame skyrocketing house prices, the central government has restricted house purchases since 2010 while requiring higher down payments and introducing property taxes cool down the market.

Land sales in 10 major cities more than doubled in the third quarter compared with the previous quarter, according to the real estate service provider Homelink.

Local governments in the 10 cities - which include Beijing, Shanghai and Guangzhou - received 135.2 billion yuan from selling land parcels in the third quarter, an increase of 123.8 percent from the second quarter, according to Homelink.

Li Ming, president of Sino-Ocean Land Holding Ltd, said it is natural that property companies are boosting their land reserves, noting their cash flow has largely improved due to the market recovery.

"Such a trend is expected to continue to the first quarter of next year," said Li. "We will definitely buy land parcels in the second half of the year, but the criterion is that the gross profit of developing the land parcels should be higher than 30 percent."

Sino-Ocean Land currently has 2.3 million square meters of land reserves, which Li said is enough for the company's development in the short term.

"Now is still not the time for large-scale purchases of land parcels. And we should keep the scale of each new project under around 200,000 square meters," Li said.

Meanwhile, property developers who have met their sales targets ahead of schedule this year are unlikely to offer discounts in the remaining months of the year.

"So, prices might climb further, but at a slower pace," said Zhang from Centaline Beijing.

Bloomberg contributed to this story.

huyuanyuan@chinadaily.com.cn?