China's outbound mergers and acquisitions reached a record high in 2012 as companies and investors continued to seek opportunities abroad, especially in the energy and resources sectors.

Record-high volume

The country's total outbound M&A volume was $59.7 billion from January to Dec 13, up 23 percent from the previous year, and accounted for 7 percent of the global cross-border M&A volume in 2012, according to statistics from Dealogic Holdings PLC, an international financial-data provider.

Target Countries

Chinese investors spent up to $20.7 billion in M&A deals in Canada, which made it the largest target nation of China's outbound M&As for the first time in 2012.

The United States was listed as the second-biggest target nation of China's outbound M&As in 2012, with more than $10 billion in deal volume, nearly triple what it was in 2011.

Analysts said North America might become a new hot spot for Chinese energy investors.

Heavy-weight industries

The bulk of China's overseas investments continued to be within the energy and resources industries, reflecting its growing appetite for raw materials.

The volume of China's outbound M&As in the oil and gas industry reached $34.5 billion with 35 deals by Dec 13. That was 55.5 percent of the overall deal volume, according to Dealogic.

After the oil and gas industry, finance, mining, leisure and utilities were the top five target sectors for Chinese companies.

Thirst for energy

China's appetite for foreign energy and resources assets has remained strong over the period, accounting and consulting firm Deloitte Touche Tohmatsu said in a report.

In 2005, just 10 China outbound energy and resources deals were announced. In 2008, the number had grown to 34, and over the first nine months of 2012, 39 such transactions had come to market, it said.

Private investors

The increasing participation of private capital is another trend of China's outbound M&As.

For the first nine months of 2012, 62.2 percent of the outbound M&A deals involved private companies, the first time that private companies' deals outnumbered those of State-owned enterprises, according to He Zhenwei, deputy secretary-general of the China Industrial Overseas Development & Planning Association.

Dalian Wanda Group Co Ltd last year completed its $2.6 billion acquisition of AMC Entertainment Holdings Inc, the world's second-largest theater chain.

The deal is the largest outbound M&A of a Chinese private company on the record and was the third-largest deal in 2012.

'Space-TimeTunnel' opens in Guangzhou airport

'Space-TimeTunnel' opens in Guangzhou airport

Top 5 property destinations for Chinese investors

Top 5 property destinations for Chinese investors

The world's top 10 energy-efficient economies

The world's top 10 energy-efficient economies

Humanoid robots shine at the World Robot Exhibition 2016

Humanoid robots shine at the World Robot Exhibition 2016

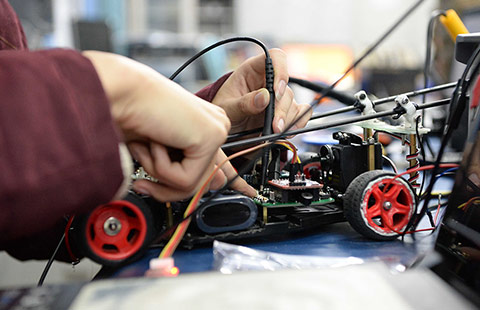

Intelligent vehicle innovation club in NE China

Intelligent vehicle innovation club in NE China

Brick miniature of ancient palace on display in Xi'an

Brick miniature of ancient palace on display in Xi'an

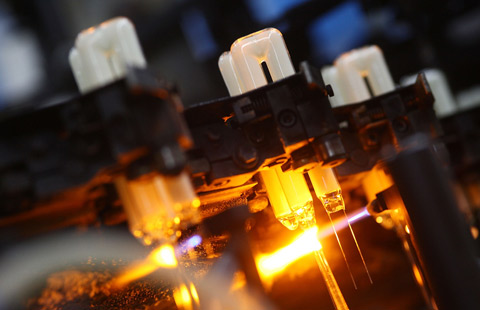

Pottery craftworks made by 3D printer seen in Jingdezhen

Pottery craftworks made by 3D printer seen in Jingdezhen

Top 13 wealthiest Chinese in 2016 Hurun Rich list

Top 13 wealthiest Chinese in 2016 Hurun Rich list