Businesses turn cautious because of growing concerns over finance: Report

Very few Chinese businesses have merger and acquisition plans in the next three years because of increasing concerns over financing, a report by international accounting firm Grant Thornton showed on Thursday, suggesting a more cautious attitude toward business expansion.

|

|

|

|

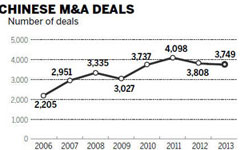

Because of uncertain economic and policy conditions, M&A activity in the China market saw a weaker performance in the first quarter of 2014.

Statistics from China Venture revealed that 372 acquisitions took place in the first quarter, falling by 45.13 percent over the previous quarter and dropping by 43.81 percent over the same period of last year.

Financing difficulties and rising costs are still considered to be the most important factors constraining businesses' M&A plans, particularly for small and medium-sized enterprises, according to Xu Hua, chief executive officer of Grant Thornton.

According to the survey, 46 percent of China businesses believe retained earnings remain the primary financing source for M&As in the next three years, a rise by 10 percent from last year.

In the meantime, Chinese businesses' expectations from financial channels including bank finance (22 percent), initial public offerings (15 percent) and private equity (8 percent) are lower than last year.

Despite steady economic development this year, the potential pressure of an economic downturn in China should not be neglected, according to Xu.

"The production and operation of Chinese businesses are still troubled by lack of orders, rising costs of labor and capital shortages, which result in more conservative planning regarding M&A activities," said Xu.

"The production and operation of Chinese businesses are still troubled by lack of orders, rising costs of labor and capital shortages, which result in more conservative planning regarding M&A activities," said Xu.

However, the government has indicated that measures will be implemented to reduce financing costs for businesses.

The survey reveals that among Chinese businesses with acquisition plans, only 29 percent show interest in cross-border transactions, declining from 47 percent last year. The developed economies in Europe and the United States have stronger growth momentum, and the requirements for investors there are stricter, which affects the willingness of Chinese businesses to undertake cross-border M&A activities.