|

|

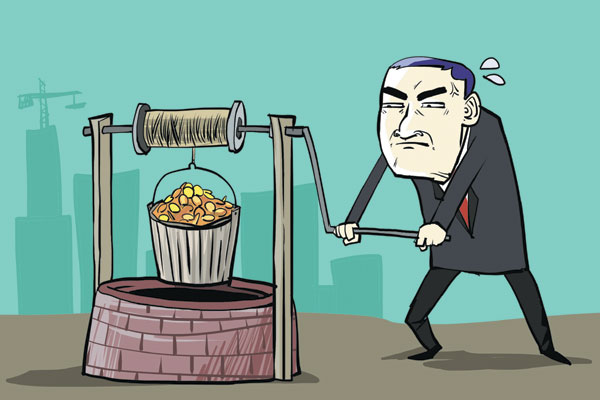

[Zhang Chengliang for China Daily] |

All this year the Chinese government has pressed on with its reform agenda, and even as it has done so it has by no means forgotten the importance of economic growth.

However, many indicators point to sluggishness in this regard, and the government needs to introduce stronger stimulus to keep growth closer to the 7.5 percent target. It also needs to continue its targeted stimulus.

Given that inflation is under control, an interest rate cut could be the near-term solution to the high cost of financing for businesses and the slumping housing market.

Rising credit risks are just one reason why policymakers should introduce such broad-based stimulus. At the end of June, credit quality continued to deteriorate as the number of non-performing loans rose 28.7 percent year-on-year, and the non-performing loan ratio rose to 1.08 percent. This suggests credit and lending risks are on the rise.

That would not be entirely unexpected for policymakers, who have tried to stabilize growth using targeted stimulus, ranging from reducing the required reserve ratio for rural commercial banks and those lending for agriculture, cutting taxes for small businesses, to altering the way loan-to-deposit ratios are calculated. But industry stakeholders facing difficulties need more help.

Although GDP growth is stabilizing around 7-7.5 percent, stakeholders, particularly small and medium-sized enterprises, continue to face mounting pressure, including weak demand and high cost of financing.

In first- and second-tier cities, many SMEs say gaining access to adequate credit in the regular banking system remains difficult. Such businesses often need to resort to non-bank financial institutions, despite the high costs.

A broad-based interest rate cut now could ease the pain because it would likely reduce the cost of borrowing. Such a cut could also help the property sector by reducing borrowing costs for developers and mortgage rates for homebuyers.

The property sector performed poorly in the Chinese economy in the first half. The real estate climate index, which measures factors including sources of funds, area of land development and area of building construction, was 94.79 in August, a level last seen in 2009 in the midst of the global financial crisis and in 2012 when GDP growth fell in six consecutive quarters.

Weak property investment sentiment can be attributed to the lack of alternative financing sources. Overall, investment property was worth 12.2 trillion yuan ($2 trillion) last year, and other sources of financing, including trust loans, trust funds and corporate bonds, were the major source of funds, accounting for about 44.6 percent of the total. As a result of the clampdown on shadow banking, such financing options have shrunk, falling 8.1 percent year-on-year as of July.

While the other major source of self-raised funds, including retained company earnings from property sales, was widely used in the same period, the sustainability of such a trend is doubtful as property sales and profitability have headed down this year.

Price pressure is another worry for the property sector. According to recently published figures, in 68 out of 70 cities that the National Bureau of Statistics tracked, prices fell, month-on-month. A decline so widespread and so sharp has not happened since the compilation of data was revamped in 2011. Property prices in the 70 cities have fallen 1.66 percent since last December, and property developers would be feeling the pinch. In fact, the top 10 property developers' profits have fallen to their lowest since at least 2008.

Further deterioration in the property sector would hurt upstream suppliers, including the steel and cement sectors, as well as upstream suppliers of these companies. The ripple effect should surely not be ignored.

Indeed, these upstream industries already face tremendous pressure. For instance, underwhelmed by weak demand from the property sector and lingering overcapacity, the steel sector is barely profitable. Net profit margins are likely to have been about 0.4 percent in the first half of the year compared with 0.6 percent last year, even as the debt-to-equity ratio, at 225 percent, has remained. The steel industry will face further challenges if demand from the construction and property sector, which accounts for about 50-55 percent of total steel demand, remains the same or continues to fall.

|

|

|

| Weak inflation makes more room for policy change | Slower growth likely in 2015 |