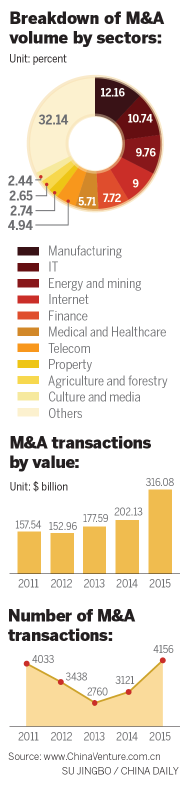

Last year saw record levels of activity in China's mergers and acquisitions. According to ChinaVenture Group, 9,700 deals were announced in the Chinese M&A market last year. Their deal value was $709.4 billion, up 78.1 percent year-on-year.

And 4,156 deals were closed in 2015 with total deal value of $316.1 billion, up 56.4 percent year-on-year.

Deals-wise, manufacturing, information technology, energy and mining were the most active sectors in 2015. In terms of deal value, however, real estate, transportation and telecommunications were the top three sectors.

Pro-industry policies and economic reforms contributed to growth in M&A activity. In particular, steady economic growth amid a series of national strategies such as "Internet Plus", the Belt and Road Initiative, deepening financial reform, and industry upgradation, were responsible for heightened M&A activity.

Nine key events marked the M&A market last year:

1. 'Internet Plus' strategy promoted M&A in the IT sector

On March 5, Premier Li Keqiang outlined "Internet Plus", a concept to integrate the Internet into every conceivable economic activity, including manufacturing. M&A deals in the Internet sector surged from the second half of last year. In all, there were 836 announced M&A deals in the Internet sector last year, up 54.2 percent year-on-year. Their deal value totaled $51.9 billion, up 197.4 percent year-on-year, ChinaVenture data showed.

2. Four agencies rolled out pro-M&A policy

On Aug 31, the China Securities Regulatory Commission, the Ministry of Finance, State-owned Assets Supervision and Administration Commission of the State Council and the China Banking Regulatory Commission jointly released a notice encouraging mergers, cash bonuses and share repurchases by listed companies as part of efforts to push forward reforms of State-owned enterprises and promote the steady and healthy development of the capital market.

3. The State Council released guidelines on entrepreneurship

The State Council released guidelines in September to accelerate exploration of new models to promote innovation and entrepreneurship. Consequently, M&As increased in the IT and advanced manufacturing sectors last year.

4. Big M&A deals clinched by Chinese buyers

PwC data showed that China's outbound M&A activity grew 40 percent by volume and 21 percent by value to reach new record highs. Privately owned enterprises continued to lead the charge, but financial buyers and private equity investors were also very active. State-owned enterprises remained somewhat subdued.

China's overseas M&A tends to pursue technologies, brands and know-how to bring them to the domestic market. Pursuing inorganic growth strategies and starting to build geographically diversified portfolios are other drivers for this outbound activity.

5. M&As at the New Third Board surged

Influenced by M&A's soaring popularity at the main board, China's third national equity market, the National Equities Exchange and Quotations, or the so-called New Third Board, had 339 mergers and acquisitions under examination and approval. Of them, 194 ones had been approved, increasing 15 percent year-on-year. Large New Third Board-listed companies such as Beijing Tongchuang Jiuding Investment Management Co and China Science & Merchants Investment Management Group made a series of M&As, leading the popularity charts in the M&A market.

6. Unsuccessful M&A spawned new opportunities

In 2015, lots of mergers and acquisitions failed because of price disagreement. From July 1 to 17, 148 listed companies released merger and acquisition statements, of which 39 failed. As the trend of M&A continues, assets that were not acquired can become new opportunities.

7. Industry leaders merged for win-win

On February 14, China's two largest mobile taxi-hailing app operators, Didi Dache and Kuaidi Dache, jointly announced their strategic merger. The new company will run on a co-CEO basis and keep the original structure of their respective human resources.

On April 17, two former competitors in online information service-ganji.com and 58.com-agreed to a strategic merge. Both companies will combine into 58 Ganji Company, which will operate a dual-brand strategy.

8. M&As in film, television sectors turned active

With annual box-office revenue totaling 44.1 billion yuan ($6.7 billion), mergers and acquisitions in the film and television sector were active, led by relative listed companies. There were 76 deals in the sector last year worth 200 billion yuan, up from 61 deals in 2014. With so many capital injections, a bubble emerged in the market.

9. Online travel sector saw more M&As

On May 8, Chinese travel website Tuniu Corp said it has sold $500 million of new shares to a group of investors led by JD.com Inc, China's No. 2 e-commerce site, as part of a tie-up to boost its customer base. In June, Chinese online travel service providers Lvmama announced that it received 500-million-yuan strategic investment from Jinjiang International Hotels Group.

With consumption upgrade, more transparent industry standards and giants' participation, online travel sector will have more M&As to improve efficiency of using resources.

Outlook for 2016

"We believe that the rate of China M&A activity will continue to grow at a double-digit pace in 2016," said Leon Qian, PwC North China Transaction Service Leader. "This will be led by domestic strategic and outbound activity. Technology will stay in the lead, as the government supports the sector as part of China's economic transformation. It will continue to attract investors looking for high growth, plus there may be some consolidation among the sector leaders."