Central bank to regulate rapidly growing fintech

|

|

A man pays using his mobile phone on a train from Tianjin to Qinhuangdao, Hebei province. XINHUA |

Big third-party payment firms, P2P lenders likely to come under PBOC oversight

China's central bank said it will strengthen regulation of companies engaged in financial technologies or fintech in a bid to prevent risks.

In a report released last weekend, the People's Bank of China said some financial products offered through internet channels by fintech companies are "systemically important" and hence will be included in its macro-prudential assessment or MPA.

The aim is to prevent cyclical risks and cross-market risk transmission, it said.

Analysts said this is the first time that the PBOC said it will include fintech businesses in its MPA.

Big players in the third-party payment services market and the peer-to-peer or P2P lending market are likely to be included first, they said.

Previously, only big financial institutions, such as banks, brokerages and insurers, who play leading roles in their respective sectors, were regarded as "systemically important" and were included in the MPA framework.

Their debt-to-asset ratio, liquidity, pricing, asset qualities, debt risks and lending policies are assessed by the central bank.

Xue Hongyan, director of the Suning Financial Research Institute, the research arm of one of China's largest fintech service providers, said considering the definition of "systemically important" services and the market size of all fintech businesses, third-party payment services and P2P lenders are most likely to become the first to be regulated under the MPA framework.

"The PBOC move … is actually a good sign for the fintech market because regulation indicates recognition of importance, and MPA, a mid-to long-term regulation framework, indicates that short-term risks are well handled," said Xue.

Ma Juan, a credit business manager with Bank of Shanghai, said the widely held view is that the P2P market's lending almost equals that of mainstream or traditional lenders.

"I don't need to name any specific provider. But we all know that the combined market size of top three players in the peer-to-peer lending market, and the top two players in third-party payments could easily exceed 1 trillion yuan ($148.8 billion)," she said.

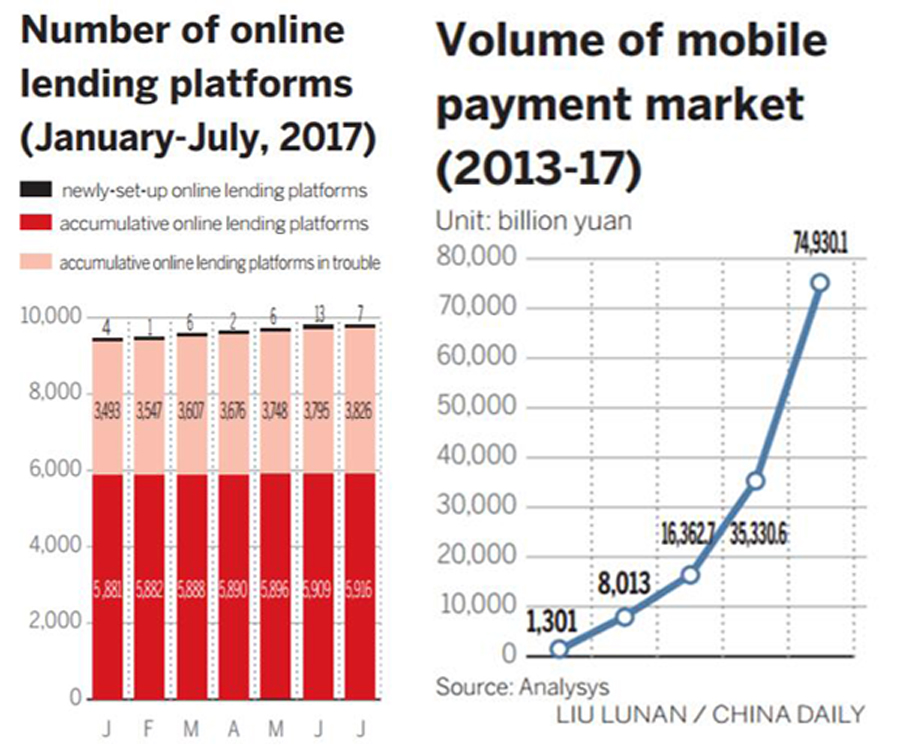

According to Home of P2P Lending, an online information provider focused on the P2P space, China has more than 2,000 online lending platforms whose combined transaction value exceeds 1 trillion yuan. Monthly inflows are somewhere between 30 billion yuan and 50 billion yuan.

The combined transaction volume in China's third-party payment market was 35 trillion yuan in 2016, and is expected to more than double by this year-end to surpass 70 trillion yuan, according to Analysys International data.

The PBOC report said currently some providers of online financial services lack "self-regulation", while some are underqualified and are too weak to manage financial risks.

Yang Tao, researcher and fintech expert with the China Academy of Social Sciences, said that strengthening regulation was inevitable as the fast growth of this segment entailed more responsibilities, making compliance key to success.