Don't shoot the messenger

Short selling by international investors is another sign that there are risks building up in China's economy

Due to the negative outlook on China's economy held by some international rating agencies, international investors such as JP Morgan Chase & Co and Citigroup recently launched a new round of short selling Chinese shares, causing the Shanghai Composite Index to drop to 2177.91 points on April 26 and fluctuate around 2220 points in the following trading days.

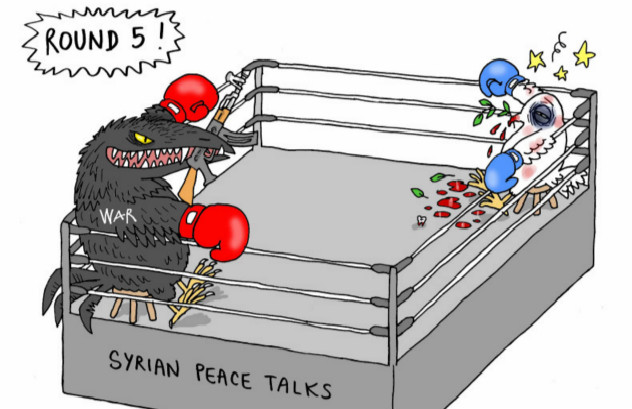

The tumbling A-share market has aggravated market panic and caused some to denounce such short selling as a plot by international investors to buy into China's stock market at cheap prices by spreading pessimism about China's economy first.

The negative outlook on China's economy by international rating agencies and investors can be attributed to its weak recovery to a large extent. China's gross domestic product grew only 7.7 percent year-on-year in the first quarter, lower than market expectations. Economic deceleration, together with a further decline of the April Purchasing Managers' Index, means the world's second-largest economy will likely face deflationary pressures than inflationary pressures in the months ahead.

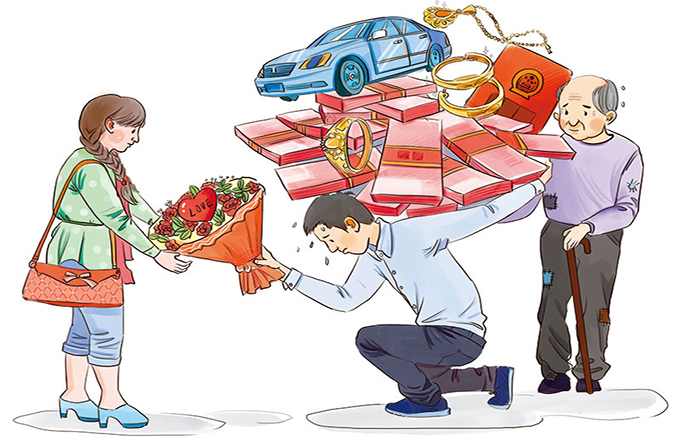

International investors also consider local government debt to be a huge risk hanging over the economy as there is still no clear plan in place to resolve the problem. The low growth in local governments' land and tax revenues over the past few months have increased concerns that these debts will continue to grow. At the same time, the rise in domestic house prices has increased the risks arising from real estate bubbles.

As well as the possibility of international investors attempting to buy Chinese stocks on the cheap by disseminating a negative outlook on its economy, there is also the possibility that they are taking precautionary measures against possible investment risks in the country. It is common for investors to sell a country's shares if they consider prices will fall. International capital operators will naturally choose to reduce their holdings of Chinese shares or financial products and derivatives denominated with the yuan once they believe systematic risks in the economy are on the rise. We should not simply interpret international investors' short selling of Chinese shares as a kind of conspiracy, because any kind of irrational short selling will possibly let slip the chance of making profits if China's economy can maintain a robust growth momentum.