Wall St sinks as fear jumps on historic downgrade

Updated: 2011-08-09 06:33

(Agencies)

|

|||||||||||

NEW YORK - US stocks plunged on Monday, taking the S&P 500 down more than 6 percent on growing fears of a recession, exacerbated by the loss of the country's pristine triple-A credit rating.

Panicked selling on heavy volume resulted in the S&P 500's worst day since December 2008, with every stock in the benchmark index ending in negative territory.

|

|

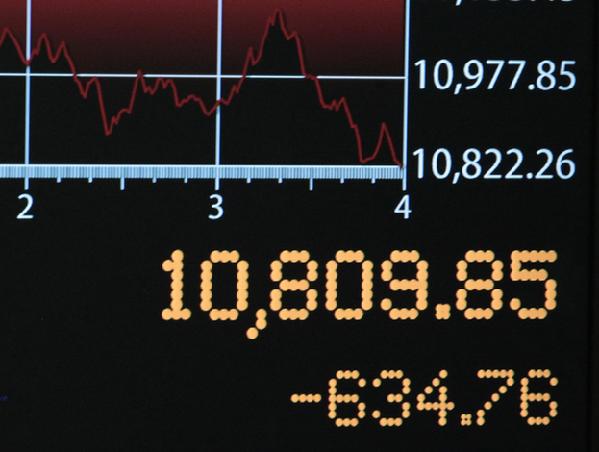

A screen displays the final numbers for the Dow Jones Industrial Average on the floor of the New York Stock Exchange August 8, 2011. Panicked selling on heavy volume resulted in the S&P 500's worst day since December 2008, with every stock in the benchmark index ending in negative territory. [Photo/Agencies] |

"We're starting to see real disorderly selling, far more than what we've been seeing," said Matthew Peron, head of active equities at the Chicago-based Northern Trust, which has about $650 billion in assets under management.

Based on the surge in the VIX, he added, "We're starting to move into panic mode."

Perceptions that Washington is incapable of addressing the problems of rising debt and slowing growth have contributed to the selling. This was underlined by selling that picked up during a statement from President Barack Obama that offered few concrete ways to resolve the fiscal and economic problems.

The anxiety about the US economy was matched by rising worries about Europe's debt problems, where the latest initiative to buy Italian and Spanish bonds is far from enough to solve the euro zone's debt crisis.

The CBOE Volatility Index, Wall Street's "fear gauge," jumped 50 percent to end at 48. This marked the first time the VIX has topped 40 since May 2010, when the "flash crash" occurred.

The S&P 500 is down 17.9 percent from its 2011 closing high, reached on April 29 - putting it close to the 20 percent decline from a recent peak that Wall Street defines as bear market territory.

Monday's slide marked the first time since November that the Dow has fallen below 11,000.

"It is a panic, and almost by definition, it doesn't have an issue. It wouldn't matter what it was," said James Paulsen, chief investment strategist at Wells Capital Management in Minneapolis, which has over $340 billion in assets under management.

|

|

A trader watches his screen on the floor of the New York Stock Exchange August 8, 2011. Panicked selling on heavy volume resulted in the S&P 500's worst day since December 2008, with every stock in the benchmark index ending in negative territory. [Photo/Agencies] |

The Dow Jones industrial average lost 634.76 points, or 5.55 percent, to end at 10,809.85. The Standard & Poor's 500 Index sank 79.92 points, or 6.66 percent, at 1,119.46. The Nasdaq Composite Index plunged 174.72 points, or 6.90 percent, to close at 2,357.69.

Volume was extremely heavy, with 17.5 billion shares traded on the New York Stock Exchange, the American Stock Exchange and Nasdaq, sharply above last year's daily average of 8.47 billion.

While all 10 S&P sectors lost more than 3.5 percent, the groups most sensitive to the economy, such as banking and commodities, were the hardest hit. The S&P financial index lost 10 percent while the S&P energy index lost 8.3 percent. US crude oil futures slumped 7.3 percent.

Bank of America Corp plummeted 20.3 percent to $6.51. The Dow component was the most actively traded name on the New York Stock Exchange and the S&P 500's biggest loser.

GLOBAL LOSS OVER $1 TRILLION

Monday's global stock market sell-off wiped out more than $1.35 trillion in investor wealth worldwide, according to the 5.2 percent drop in the MSCI World Index. The index entered the week with a value of $26.42 trillion.

The S&P 500 alone lost $729.3 billion in value with its drop for the day of 6.66 percent.

Late on Friday after the market's close, S&P cut the United States' perfect long-term credit rating of AAA by one notch to AA-plus on concerns about debt levels in the world's largest economy. The downgrade could eventually raise borrowing costs for the US government and companies, as well as for consumers.

On Monday, President Obama blamed the downgrade on political gridlock in Washington and said he would offer some recommendations on how to reduce federal deficits.

"Investors wanted more specifics from Obama, but I don't know if that's reasonable right now," Peron said. "When we see a credible policy response, that's when we could see a bottom."

Traders also cited expected redemptions and margin calls for the sharp early afternoon declines.

"We saw a lot of short selling coming in, especially into ETFs at around 2:15" p.m. said Glenn Starkman, global head of sales trading at Dahlman Rose in New York.

About 66 stocks fell for every one that rose on the New York Stock Exchange, while on the Nasdaq, 22 stocks fell for every one that rose.

Even the European Central Bank's dramatic intervention in bond markets, which pushed down yields on Spanish and Italian bonds, was not enough to stem selling.

GETTING CLOSE TO A BOTTOM?

But some analysts noted the mass selling has made some stocks attractive at much lower prices.

"Based on historical sell-offs, it wouldn't be surprising to see a rebound in the more oversold areas, given how far down we've come and how fast," said Brad Sorensen, director of market and sector analysis at Charles Schwab in Denver.

Barclays Capital, in a note to clients, wrote that the decline created a "time to buy," and that the recent losses "left equity valuations at levels of cheapness not seen since the early 1980s.

"I've been in this business almost 30 years. When it gets to the point where you want to throw up, it's probably time to buy, and we're there," said Angel Mata, managing director of listed equity trading at Stifel Nicolaus Capital Markets in Baltimore.

Related Stories

Asian stock markets sink after US credit downgrade 2011-08-08 14:49

China urged to stand pat on US debt 2011-08-08 16:57

HK economy safe from US credit downgrade: official 2011-08-08 16:32

Geithner slams S&P downgrade of US rating 2011-08-08 09:50

Why S&P downgrades US credit rating 2011-08-07 12:03

US loses AAA credit rating from S&P 2011-08-06 10:56

Hot Topics

The European Central Bank (ECB) held a conference call late on Sunday ahead of the market opening, pledging the ECB will step in to buy eurozone bonds with efforts to forestall the euro zone's debt crisis from spreading.

Editor's Picks

|

|

|

|

|

|