City's de facto central bank sells HK dollars for the 4th time to fight hot money inflow

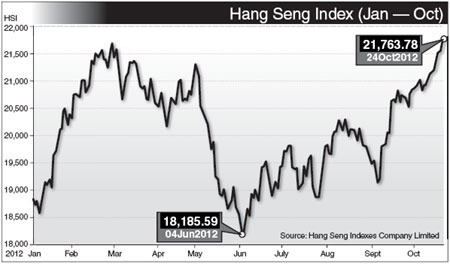

The Hong Kong Monetary Authority (HKMA) intervened again on Wednesday in the currency market, selling $395 million worth of Hong Kong dollars in its latest action to defend the Hong Kong dollar peg to the greenback, while the Hang Seng Index surged to its highest level this year to 21,763.78 as hot money flowed into the region.

The latest HKMA intervention, the fourth time since last Saturday, came as the local currency continued to surge, touching the upper limit of a 29-year-old peg to the US dollar.

Under the currency board system adopted by the HKMA, the city's de factor central bank, the Hong Kong dollar is permitted to trade between 7.75 and 7.85 to the US dollar, and a breakthrough of the range normally triggers intervention by the HKMA.

The HKMA has sold a total HK$14.4 billion ($1.85 billion) Hong Kong dollars in its interventions over the past several days. The latest intervention will lift the aggregate balance - the sum of balances on clearing accounts maintained by banks with the HKMA - to HK$163 billion on Oct 25, according to Reuters data.

The HKMA's last series of interventions took place between the fourth quarter of 2008 and the end of 2009, following the collapse of Lehman Brothers, when the central bank sold HK$640 billion into the market.

The surging Hong Kong dollar signals the accelerated inflow of "hot money" after the US Federal Reserve's third round of quantitative easing (QE3).

"We expect net inflows into the Hong Kong dollar will continue for sometime," the HKMA said on Wednesday, noting that demand for Hong Kong dollars has increased since the QE3, and similar rises are also noted in other currencies within the region.

"We will monitor the situation closely and maintain the stability of the Hong Kong dollar in accordance with the Currency Board mechanism," it said in an emailed statement.

The capital inflows to the region were partly stimulated by latest data that indicated improvements in China's economy, said Chan Ka Keung, Secretary for Financial Services and the Treasury, on Wednesday.

The influx of international capital, or merely the news of capital inflows, has boosted the city's stock market, which saw its benchmark Hang Seng index rise for the ninth consecutive day on Wednesday to its highest level this year, against the generally weaker markets overseas.

The return of "hot money" has aggravated fears of increasing bubble risks in the property market after home prices in the city climbing over 90 percent since early 2009 and surpassing their October 1997 peak, fuelling calls for a review or abolition of the peg.

However, some market watchers expect the peg to stay.

"Regardless of recent flows, I continue to believe the HKD peg to the USD will persist since the system keeps the currency and economy stable and there will also be shortcomings if the HKD is pegged to other currencies," said Adrienne Lui at Citi Group.

The link will remain because conditions for a possible alternative peg to the yuan, such as currency convertibility, aren't in place, Goldman Sachs Group Inc said in a report on Tuesday.

The Hang Seng Index rose 0.3 percent to 21,763.78 at the close, a ninth straight advance, as foreign flowed into the city.

China Daily - Bloomberg